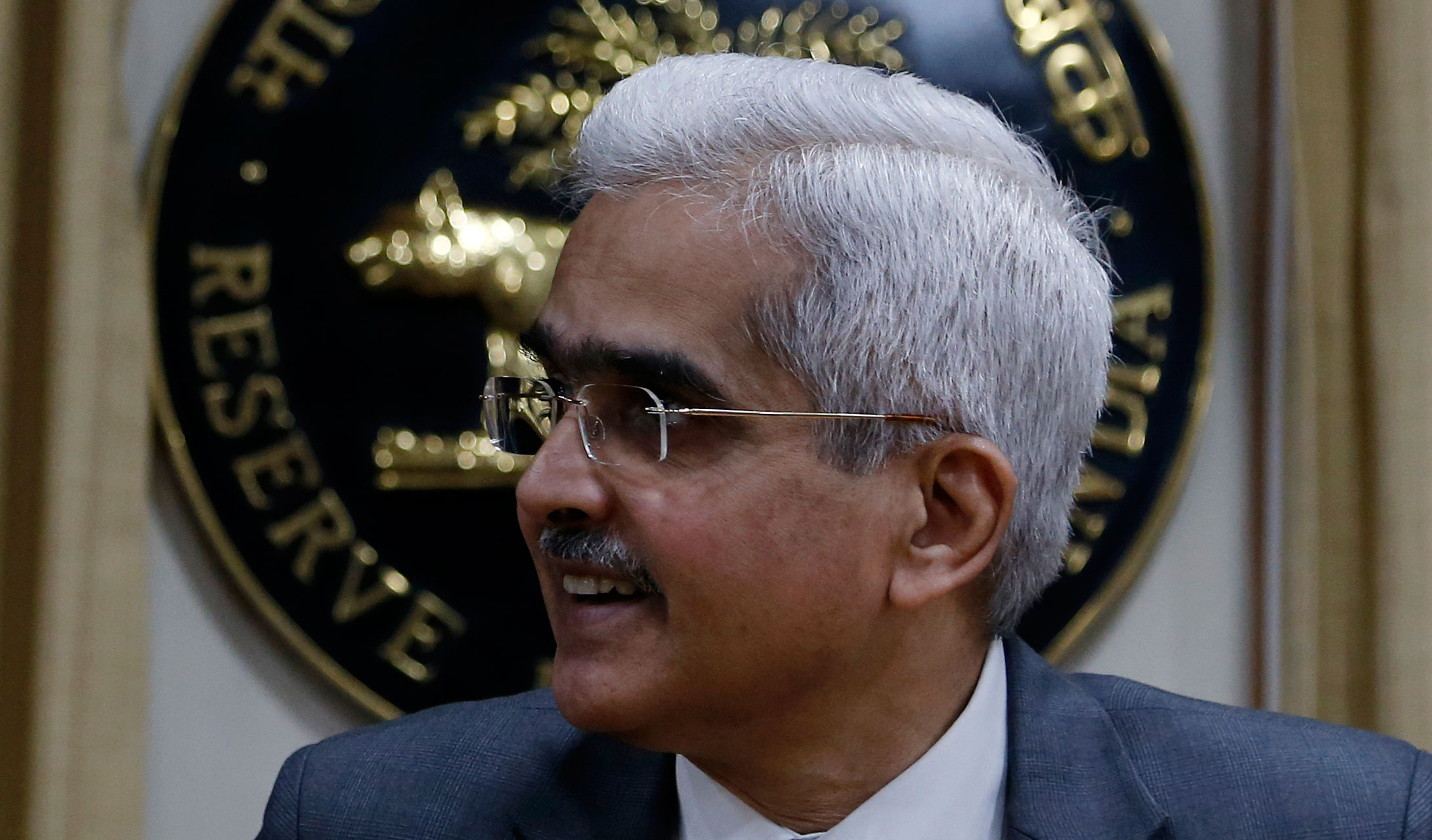

The Reserve Bank of India has, once again, used the scalpel in its monetary policy toolbox to cut the repo rate to 5.15 per cent, ostensibly to kick-start a faltering economy. The 25 basis point cut on October 4 — the fifth time it has cut the policy-signalling interest rate this year by a cumulative 135 basis points — puts the repo within a short distance of its all-time low of 4.75 per cent reached in April 2009. The RBI governor, Shaktikanta Das, refused to speculate on whether the policy rate would plumb a new depth if the measures adopted by the central bank and the government fail to crank up growth. The central bank is only too aware that hacking the policy rate will not magically ignite a moribund economy. But it persists with that policy — without being able to force the banks to pass on the benefit to borrowers — under pressure from the Narendra Modi government.

The RBI policymakers have hit back at the government in the only way they can: they have slashed their growth forecast for the Indian economy to 6.1 per cent for this fiscal, down from a fairly robust 7.2 per cent on April 4 when the monetary policy mandarins sat down for their first bi-monthly monetary policy review for 2019-20. Clearly, all the engines of the economy have started to backfire. If manufacturing had been the sector in the doghouse at the start of this fiscal, it has increasingly become evident that two other key segments — agriculture and services — have started to suffer the withering effects of the economic slowdown. The Central Statistics Office had pencilled a growth rate of 5 per cent in the first quarter ended June 30, the slowest growth rate in over six years. The RBI has now second-guessed the growth rate in the second quarter ended September 30 at 5.3 per cent. If true, this means that the first half of this year has been a huge washout.

The steady stream of gloomy data confutes everything that the Centre has been saying about the economy. The outcome of a clutch of independent surveys carried out by the RBI provides a sobering reality check: the median inflation expectation of households has hardened to 8 per cent in September from 7.6 per cent in July — way above the RBI’s own forecast of 3.5-3.7 per cent for the second half; business confidence has plummeted to its lowest level since March 2014; capacity utilization in the manufacturing sector has sunk to 73.6 per cent; and industry’s expectations on profit margins has tumbled to -8.5 per cent in the third quarter ended December 31 from 7.4 per cent in the second quarter. The stream of domestic data and the poor confidence indicators thrown up by the business and consumer surveys have already soured the pot of hopes.