Mumbai, Nov. 29: Bharat Financial Inclusion (erstwhile SKS Microfinance) today said it was witnessing a collection efficiency of 97 per cent with a lag of two weeks, notwithstanding the government's decision to demonetise Rs 500 and Rs 1,000 notes.

In a filing with the bourses, the microfinance company, which gave details of collections from November 11-18, revealed that the collection efficiency had varied between 92.6 per cent and 97.1 per cent. On November 11, collections stood at Rs 6 crore against dues of Rs 59 crore. However, collections against overdue improved in the next two weeks and the total amount garnered went up to Rs 57 crore, reflecting an efficiency of 97 per cent.

The announcement allayed concerns that collections by microfinance institutions would be adversely affected following demonetisation as dues were collected almost entirely in cash.

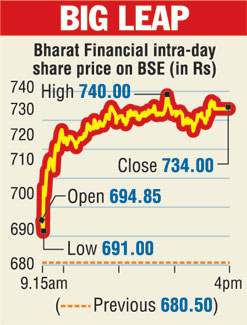

On the BSE, shares of Bharat Financial closed with gains of Rs 53.50, or 7.86 per cent, at Rs 734.

The company said after demonetisation, it was not only giving customers time to repay but had also been educating them to exchange high denomination notes at banks and post offices. It added that 99 per cent loans were meant for income-generating activities.

"The collection efficiency statistics provided by Bharat Financial are quite encouraging, in our view, given the gravity of the situation and reinforces the strength of the weekly collection-based Joint Liability Group model," Morgan Stanley said in a note.