Benchmark equity indices BSE Sensex and NSE Nifty tumbled more than 1 per cent on Friday due to a broad-based selloff, especially in metal, IT and commodity stocks, tracking sluggish global markets.

A weaker-than-expected earnings season and emerging pressure on technology stocks amid concerns about AI-led disruption also dampened sentiment, traders said.

In a volatile session, the 30-share Sensex tumbled 1048.16 points, or 1.25 per cent, to close at 82626.76. During the day, the benchmark tanked 1140.37 points, or 1.36 per cent, to hit an intraday low of 82534.55. A total of 2,960 stocks declined, while 1,253 advanced and 151 remained unchanged on the BSE.

The 50-share Nifty plunged 336.10 points, or 1.30 per cent, to settle at 25471.10. In intraday trade, it slumped 362.9 points, or 1.4 per cent, to hit a low of 25444.30.

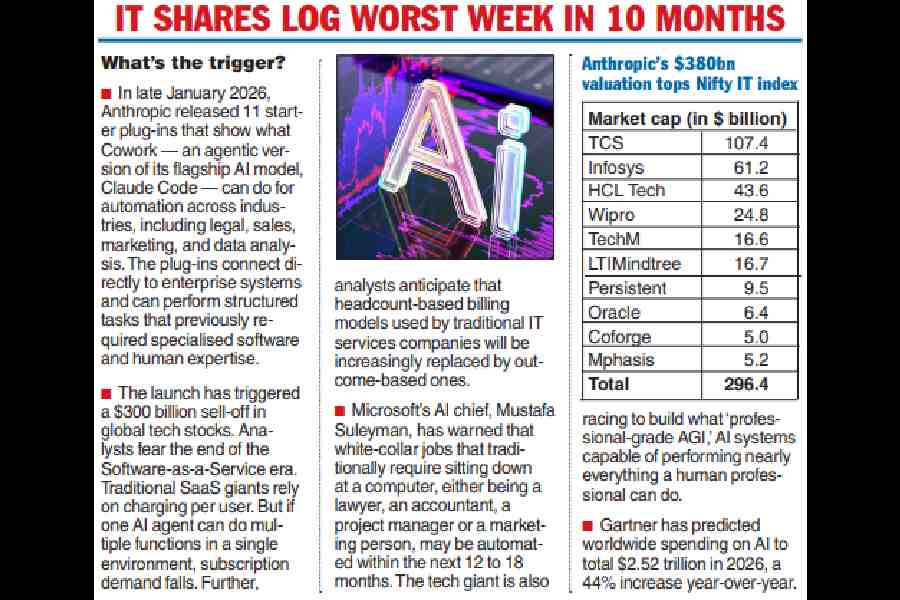

IT shares logged their worst week in over 10 months, extending a rout driven by fears of disruption from artificial intelligence tools that wiped about $50 billion off the sector’s market capitalisation in February.

The launch of a tool by AI firm Anthropic triggered a global tech sell-off, intensifying concerns that rapid adoption of generative AI could upend India’s $283 billion IT services industry. For the week, the Nifty IT index slid 8.2 per cent, its steepest fall since April 2025. The market cap of the index in Dollar terms fell below that of Anthropic’s reported valuation of $380 billion after its latest fund raise of $30 billion.

Analysts at JP Morgan flagged concerns that Indian IT firms could miss growth targets as clients reallocate spending.

Sat Duhra, portfolio manager at Henderson Far East Income, said IT companies probably haven’t done the greatest job in terms of communicating how they can turn AI into an opportunity rather than a threat.

JP Morgan noted it is simplistic to assume AI can replace enterprise-grade services, calling IT firms the “plumbers” of enterprise tech.

On a weekly basis, the Sensex fell 953.64 points, or 1.14 per cent, while the Nifty dropped 222.6 points, 0.86 per cent. BSE market capitalisation eroded by ₹7.02 lakh crore to ₹465.47 lakh crore ($5.13 trillion).

“Sentiment gains from the US-India trade deal have faded as renewed AI-driven disruption fears weigh on risk appetite, with markets worrying that Indian IT firms dependent on the labour arbitrage model may face tougher competitive pressure than their Nasdaq peers,” Vinod Nair, head of research at Geojit Investments, said.

Metals saw profit-booking amid a stronger dollar and reports of Russia’s possible return to dollar settlement.

Gold and silver slid over 5 per cent in Delhi after strong US jobs data damped near-term rate-cut hopes at the Federal Reserve. The rupee closed at 90.64 per dollar.

FIIs bought equities worth ₹108.42 crore on Thursday, while DIIs were also net buyers of stocks worth ₹276.85 crore. Brent crude rose 0.32 per cent to $67.81 per barrel.