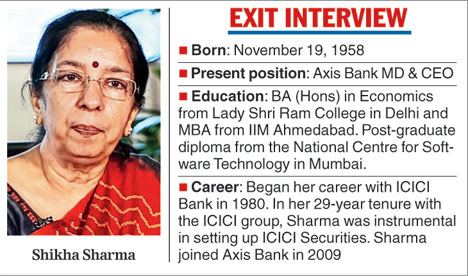

Mumbai: Shikha Sharma has decided to cut short her tenure at Axis Bank, the country's third largest private sector lender. Sharma, who had won a fourth extension from its board till June 2021, will now be at its helm only till December 31, 2018, subject to Reserve Bank of India's (RBI) approval.

In July last year, the board of Axis Bank had extended her tenure as the managing director & chief executive officer by three years with effect from June 1, 2018.

"Shikha Sharma has requested the board to revise the period of her re-appointment as the managing director & CEO of the bank from June 1, 2018 to December 31, 2018. The board has accepted her request, subject to the approval of the RBI," Axis Bank said in a regulatory filing with bourses after a board meeting.

This will mean that Sharma, who had taken charge at the bank on June 1, 2009 (she moved from ICICI Prudential Life Insurance Company where she was the CEO & managing director), will exit Axis nearly 30 months ahead of her stipulated tenure.

The development comes after the RBI had asked the Axis Bank board to re-consider the extension given to Sharma. The central bank was reportedly not happy with the recent performance of the lender and the RBI is believed to have cited the deteriorating asset quality of the bank over the years.

For the quarter ended December 31, 2017, the gross non-performing assets of Axis Bank stood at 5.28 per cent and in absolute terms it was a little over Rs 25,000 crore. In the quarter ended September 30, 2009, while the percentage of gross NPAs was 1.21 per cent, in absolute terms it stood at Rs 1,131 crore.

Deteriorating asset quality apart, Axis Bank was recently in the news for the divergence with the RBI in NPA classification for 2016-17. While gross NPAs as reported by the bank stood at Rs 21,280.48 crore, the same, as assessed by the RBI, stood at Rs 26,913.28 crore, a divergence of Rs 5,633 crore. In March, the central bank had imposed a Rs 3 crore fine on Axis Bank for not complying with its directions on the classification of NPAs. During demonetisation, Axis Bank was in the news for the alleged involvement of some of its staff in illegal practices.

WhatsApp leak

Recent investigation by market regulator Sebi had revealed that messages circulated in WhatsApp groups "almost matched" with the financial results of Axis for the quarter ended June 30 2017, which were published subsequently.

Gross NPA, net NPA, net interest margins, write-offs and CASA were some of the key numbers that were circulated among WhatsApp groups.

Sebi had consequently asked the bank to conduct an internal inquiry into the leak of unpublished price sensitive information, take appropriate action against those responsible and complete the inquiry within a period of three months.

While it is not known why Sharma has offered to stay till December 31, analysts said it could be to ensure a smooth transition.

There was a buzz regarding her exit last year with reports saying that the lender had appointed an executive search firm to find her successor. It was also speculated that she had been approached by Tata Sons chairman N. Chandrasekaran to lead the group's financial services businesses.

The stock markets perhaps had a whiff of Monday's announcement as the Axis Bank stock finished with gains of 3.44 per cent on the Bombay Stock Exchange ahead of the announcement.