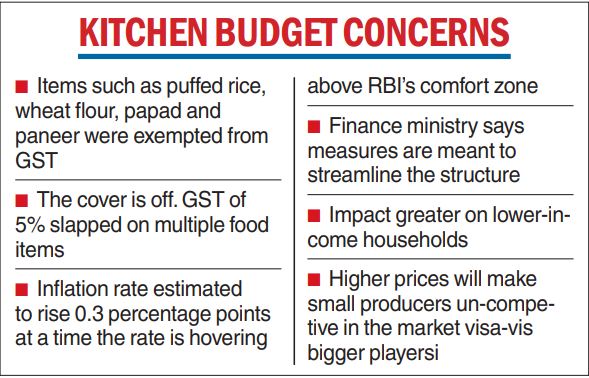

The decision to bring a bunch of daily eatables within the GST net is set to increase household budget even as the RBI tries to tamp down the inflation rate, which at 7 per cent is beyond its comfort level.

The move to bring in prepacked and labelled puffed rice (muri), wheat flour, papad, paneer, curd and buttermilk within the GST tax structure would add to the inflationary pressure on the economy and goes contrary to the steps taken by the Modi government and the Reserve Bank of India (RBI) to contain prices, economists said.

The new tax rates would be applicable from July 18. Shilan Shah, senior India economist CapitalEconomics, said the decisions of the GST Council at its Chandigarh meeting last week were unexpected.

The finance ministry said the changes were technical in nature and were meant to streamline the existing structure of rates. “The decision comes as something of a surprise.

After all, it goes against the grain of the recent fiscal developments, which have tended to lead to a looser fiscal stance, for example, the cut to excise duties on fuel,” Shah said.

The more significant impact of the GST hikes will be on inflation, specifically for food. As a result of the changes, foods that account for around 15 per cent of the consumer-price -inflation basket are now subject to a 5 per cent tax if they are unbranded and pre-packaged, from zero previously.

“Assuming a quarter of those foods meet that (unbranded) definition, that would add to 0.2 percentage points to headline inflation. Additionally, higher taxes on inputs for processed grains, pulses and dairy, which account for almost 20 per cent of the CPI basket, will put further upward pressure on consumer prices,” he said. “Our rough estimate suggests that they could boost headline inflation by up to 0.3 percentage points from August onwards.”

Yuvika Singhal, an economist at QuantEco Research, said: “While the focus of the GST Council has been on rationalising rates and rectifying the inverted duty structure, the imposition of GST on some of the food items of mass consumption is bound to add to an upside to food inflation and perhaps marginally to inflation expectations. ” “The inflation impact of GST rate rationalisation undoubtedly will be more pronounced on lower-income households, though difficult to quantify.” She said the impact would be seen on the July and August inflation data.

“The GST Council has decided to include pre-packed and pre-labelled foodgrain and other items under the GST tax slab of 5 per cent which will make small manufacturers and traders uncompetitive in the market,” Praveen Khandelwal, National Secretary General, Confederation of Indian Traders (CAIT), said.

“Any rate rationalisation to boost state revenues at the brink of the end of the GST compensation era triggers fears of higher prices, at a time high inflation already poses a concern,” Aditi Nayar, chief economist, Icra, said. The move may shift preferences towards branded items and level the playing field between branded and unbranded items. The consumer price index-based inflation is hovering at record high levels of over 7 per cent, forcing the RBI to hike the repo rate by 90 basis points in two straight months.

Rate racks

The GST Council also raised the rates on pre-packed and labelled meat, except frozen, honey and dried leguminous vegetables.

All goods with organic manure and with pith compost will attract a 5 per cent tax rate.

The inverted duty for a host of items, including edible oil, coal, LED lamps and solar water heater was corrected.