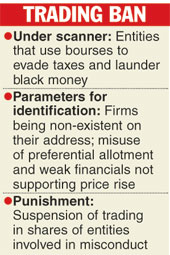

New Delhi, Feb. 8 (PTI): Cracking the whip on entities using the stock markets to evade taxes and launder black money, the Securities and Exchange Board of India has decided to suspend trading in listed companies that are found to be used by such manipulators.

The regulator has identified three parameters to take action against such companies, and the trading will be suspended in the shares of those entities that satisfy more than one of the criteria.

'These parameters include these companies being non-existent on their mentioned address, misuse of preferential allotment and weak fundamentals not supporting price rise,' a senior official said.

In its probe into various such cases, Sebi found huge share price rally in the shares of the companies that existed only on paper and did not even exist on the addresses mentioned in their regulatory filings, while preferential allotment has emerged as a major route to launder illicit funds.

The modus operandi typically involves stock market dealings aimed at evading capital gains tax and showing the source of income as legitimate from stock markets.

Sebi found a typical pattern in the trading of shares of these companies. First, the shares would be allotted on a preferential basis to certain connected entities, price would be pushed higher without any fundamental move, followed by an exit being given to these investors and the shares would be sold back to the company or related entities raking in huge profits.

Such huge profits were made in stocks where the fundamentals or financials of the companies did not justify the price. A large number of small NBFCs and brokers are already under Sebi's scanner for having facilitated illicit transactions worth thousands of crores of rupees over the past 2-3 years, sources said.

It has emerged during investigations by Sebi and stock exchanges that such illicit activities tend to accelerate during the last few months of a fiscal and the amount of such transactions has grown manifold in the last few years.

Besides, a number of such entities, which include both individuals and corporate brokerage firms, have been found to be repeat offenders for various offences in the securities market and many of them create new shell companies to hide their past precedents.

Those under the scanner also include some listed firms and their promoters, who regularly offer their services to channelise black money and evade taxes through the bourses.