Mumbai, Aug. 11: The $41-billion Aditya Birla group today unveiled a mega restructuring exercise to merge Aditya Birla Nuvo with Grasim Industries.

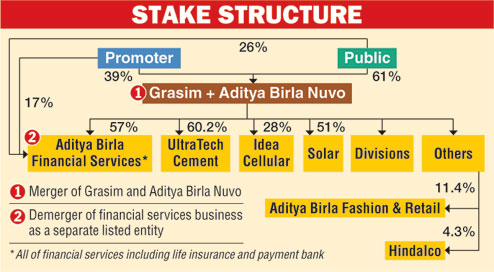

After the amalgamation of Nuvo into Grasim, the financial services business of Nuvo will be demerged into a separate listed entity -Aditya Birla Financial Services (ABFSL).

For the merger of Nuvo with Grasim, each shareholder of Nuvo will get three new equity shares of Grasim for every 10 equity shares held.

Similarly, for the demerger of the financial services business into ABFSL, a Grasim shareholder (post-merger) will receive seven equity shares in ABFSL for every 1 held in Grasim. Therefore, a Grasim shareholder holding 100 shares will receive 700 shares in ABFSL. On the other hand, a shareholder of Nuvo will receive 210 shares of ABFSL for every 100 held.

ABFSL is a subsidiary of Aditya Birla Nuvo. The latter also holds a stake in Birla Sun Life Insurance, which will now be transferred to ABFSL, subject to regulatory approvals.

Following the complex restructuring, the merged entity will own 57 per cent in ABFSL, 60.2 per cent in UltraTech Cement and 28 per cent in Idea Cellular. It will also hold stakes in other divisions such as textiles, chemicals, insulators apart from Aditya Birla Fashion & Retail and Hindalco.

"The proposed restructuring will create one of India's largest, well-diversified companies with a healthy mix of businesses having steady cash flows and long-term growth opportunities. The demerger and listing of the financial services business will unlock value for shareholders," said Kumar Mangalam Birla, chairman of the Aditya Birla group.

According to senior group officials, the move will also simplify the group structure as it will bring together similar businesses. For instance, the viscose filament yarn business of ABNL will synergise with the viscose staple fibre business of Grasim.

The merged entity will have revenues of almost Rs 60,000 crore. The financial service business has assets under management of Rs 1,84,276 crore as of March 31, 2016.

Birla denied speculation that the merger has been proposed to bankroll the capex of Idea Cellular. "It is preposterous to assume that the restructuring is being done to fund Idea... There is no intent to help Idea through this merger.'' The telecom firm will take care of its own finances, he said.

The transaction is expected to be completed by the fourth quarter of this fiscal or the first quarter of next year.

The Grasim share fell by Rs 312.55, or 6.46 per cent, to close at Rs 4,538.95 on Thursday, while the Aditya Birla Nuvo share rose by Rs 52.95, or 3.5 per cent, to finish at Rs 1565.70 on the Bombay Stock Exchange.

Grasim Industries today reported a 64 per cent jump in consolidated net profit to Rs 830.22 crore for the quarter ended June 30. The firm had clocked a net profit of Rs 507.60 crore a year ago.