Calcutta: Shree Cement plans to tap the demand for housing and infrastructure in West Asia with its proposed acquisition of UAE-based Union Cement. The move, once completed, will mark the first overseas foray of the cement maker.

Shree Cement plans to acquire a minimum of 92.83 per cent in Union Cement. The enterprise value of the Abu Dhabi Securities Exchange-listed firm is $305.24 million (Rs 1,942 crore). The acquisition, which will involve the conversion of Union Cement from a public joint stock company to a private joint stock company and delisting it from the stock exchange, is expected to be completed in nine months.

With the acquisition, the aggregate capacity of Shree Cement will increase to 33.3 million tonnes per annum (mtpa) from 29.3 mtpa. In India, the HM Bangur-led cement company has plants in Rajasthan, Haryana, Uttarakhand, Uttar Pradesh, Bihar and Chhattisgarh.

Union Cement has its operations in Ras Al-Khaimah with a clinker capacity of 3.3 mtpa and a cement capacity of 4mtpa. With manufacturing units close to Ras Al Khaimah's Saqr port, the company serves the export markets of the Gulf countries, West Asia and east Africa.

The company produces ordinary portland cement, sulphate resisting cement and oil-well cement.

Its consolidated revenue and earnings before interest, tax, depreciation and amortisation (EBITDA) in 2016 was $153.42 million and $33.73 million, respectively.

"The proposed acquisition will help Shree Cement create its first footprint outside India. UAE is one of the major economies in West Asia which has good long-term prospects in the housing, construction and infrastructure segment," Shree Cement said in a communication to the BSE.

Baker Tilly DHC, Standard Chartered Bank and Freshfields Bruckhaus Deringer have advised Shree Cement on the proposed acquisition.

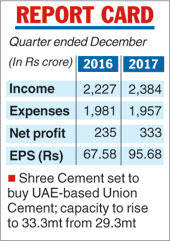

Shree Cement on Friday also reported a 41.58 per cent increase in its standalone net profit at Rs 333.33 crore for the quarter ended December.