Calcutta, Jan. 4: The microfinance industry expects a 40 per cent growth in the gross loan portfolio in 2014-15, driven largely by rising credit flow from commercial banks to the sector for on-lending.

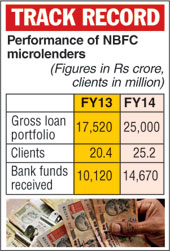

The gross loan portfolio of microfinance institutions (MFIs),that are recognised by the RBI as non-banking finance companies (NBFCs), grew to Rs 28,810 crore at the end of the September quarter of 2014-15 from Rs 25,000 crore in 2013-14.

NBFC microlenders constitute over 90 per cent of the microfinance industry.

During 2013-14, the gross loan portfolio of MFIs grew 51 per cent, excluding the non-performing assets in Andhra Pradesh.

'It can be expected that in the current financial year ending March 2015, even after the high base effect, the gross loan portfolio of MFIs will grow around 40 per cent,' said Alok Prasad, chief executive officer of Microfinance Institutions Network, an industry association for NBFC micro lenders.

Lack of mainstream banking in various regions along with rising credit flow from the commercial banks has fuelled the growth in the loan portfolio of such microfinance bodies.

'There is an extremely large untapped market, both rural and urban, which the mainstream banks are not serving. A robust core business model, growing credit demand, strong fund flow from commercial banks and the supportive policy stance of the RBI have contributed to the growth in the loan portfolio,' Prasad said.

According to RBI data, credit flow from commercial banks to NBFCs has so far seen a year-on-year growth of 7 per cent with priority sector lending rising 16 per cent.

Bank credit to microfinance institutions extended on or after April 1, 2011, for on-lending to individuals and self-help groups is classified under the priority sector.

Kuldip Maity, managing director of city-based Village Financial Services, said besides credit, MFIs were seeing a rising demand for insurance and pension products.

Prasad said microfinance institutions were also keen on the small finance bank licence.

'Becoming a bank is very aspirational and a good number of them are likely to apply to the RBI,' he said.

On the problems micro lenders may face, Prasad said, 'At the application stage, there are challenges of meeting the requirement for promoter's holding, structuring of the shareholding pattern, complying with the FDI norms and making credible business plans. Thereafter, getting the business model right, including the identification of appropriate technologies would be critical. Finally, the HR challenge would be a major issue and a crucial determinant of success.'<-4.000>The RBI has extended the last date of submitting applications for small finance and payments banks to February 2.

Calcutta-based Bandhan was the first microfinance entity to receive a full service banking licence last year.

There is a strong interest from MFIs to apply for the small finance bank licence.