Bangalore, Sept. 29: Beleaguered liquor baron Vijay Mallya today said Kingfisher Airlines had turned out to be a "nightmare" and blamed the government's adverse taxation policies and higher fuel prices for the business failure.

"The business (of Kingfisher Airlines) failed because of high fuel prices and adverse government policies on taxation and, of course, the failure of aviation engines," Mallya said in a video message to shareholders at the 100th AGM of United Breweries (Holdings) Ltd (UBHL).

"What started as the genuine business failure of Kingfisher Airlines... has now turned out to be a nightmare," he added.

"As part of its concerted efforts to make me a poster boy of bad loans and financial crime, the government continues to attach properties and threaten other forms of action, all of which, I assure you, will be contested in the courts of law, " Mallya said.

The CBI had in August filed a loan default case against Mallya, the grounded Kingfisher Airline and UBHL for allegedly causing a loss of Rs 6,027 crore to the lenders.

In its latest annual report, released to shareholders at the meeting, UBHL said it has been without a managing director since April 17, 2014.

Mallya, who left the country on March 2 and is now in the UK, has been declared a proclaimed offender by a special Prevention of Money Laundering Act court in Mumbai.

But Mallya clearly continues to hold sway in UBHL. "Even after his relocating to London, he has full control over the affairs of the company through appropriate delegation of duties to various executives who report to him on a regular basis," the report said

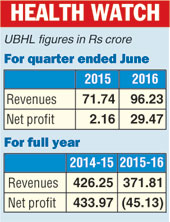

For 2015-16, UBHL suffered a net loss of Rs 45.13 crore against a profit of Rs 433.97 crore a year ago.<>

on a plea by the Enforcement Directorate in connection with its money laundering probe against him in the alleged bank loan default case.

In his address, non-executive independent director N Srinivasan who chaired the meeting, later assured the shareholders that ?gGod willing, he (Mallya) might attend the next AGM.?h

For the fifth year, the company didn?ft declare dividend. The last dividend payout was in 2010-11 when Re1 per share was declared.

But the company?fs share held out better than most on a day when markets were wobbly following news of the army raid along the LoC to destroy terror camps. While UBHL closed at Rs43.20 in NSE, it closed at Rs42.35 in BSE.