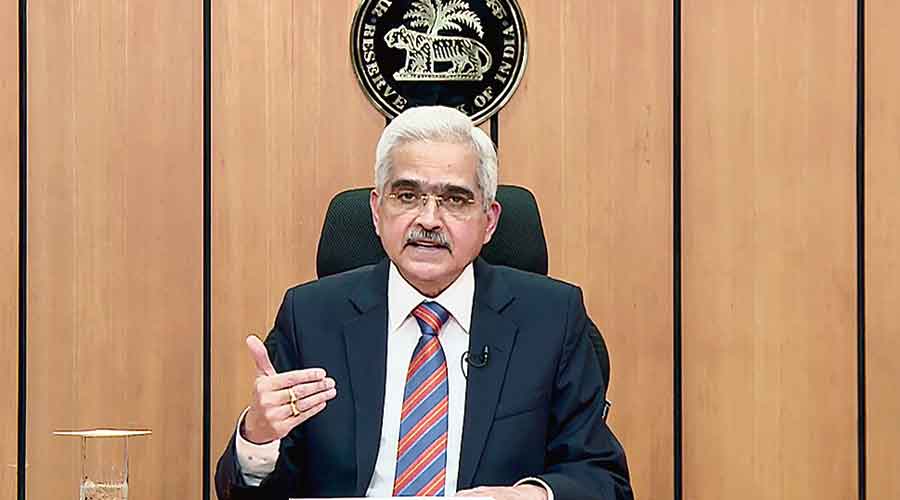

Reserve Bank governor Shaktikanta Das on Tuesday said the economy is gradually recovering from the pandemic, which is evident from the numerous high-frequency indicators.

India has the potential to grow at a reasonably high pace in the post-pandemic scenario, Das added.

Speaking at an event organised by the State Bank of India (SBI), Das advised lenders to be prudent in risk-taking and use their capital efficiently, reiterating liquidity will be available for meeting the productive needs of the economy.

The central bank has so far not revised its growth projection of 9.5 per cent for the economy, though many others have done so. Analysts will be tracking the next monetary policy meeting in December for any revision.

Das’s optimism on the economy comes a day after a monthly bulletin of the central bank referred to a durable economic recovery.

Das said though the economy was gradually getting back on its feet after a devastating second wave, the recovery has progressed in an uneven manner. Contact-intensive services are still to regain their lost capacity despite rapid improvement in the recent period.

He said India can still grow at a reasonably high pace in a post-pandemic environment. There are several factors that are stacked in India’s favour.

Apart from factors such as favourable demographics, improving skill base and strong domestic demand, the government is providing necessary support through capital expenditure and reforms in various sectors such as infrastructure, manufacturing and telecom. The Centre has also adopted measures to boost productivity, ease supply constraints and improve the business environment.

The pandemic has opened up new opportunities in digital and green technology even as the resetting of global supply chains could be advantageous to India. Exports are also likely to benefit further from global economic recovery.

Das said consumption demand triggered by the festive season was making a strong comeback, encouraging firms to expand capacity and boost employment and investment.

The recent fuel duty cuts by the Centre and many states will augment the purchasing power of people, creating space for additional consumption.

“Are we at the cusp of a virtuous feedback loop where increased demand impulses will move in lockstep with commensurate supply response and ensure sustained growth of the economy? There are reasons to be optimistic on this front,’’ he said.

The RBI governor had some advice for the banking community. He stated that there are risks and challenges which require serious introspection and action on their part. One of the main concerns that have re-emerged relates to the question of capital and provisioning buffers of banks, their adequacy and how they are used during a crisis.

"I would thus strongly urge the banks to focus and further improve their capital management processes with a forward-looking, scientific and prudent approach. The key point is to envisage the capacity for loss absorption as an ongoing responsibility of the lending institutions’’, he added.