Mumbai, March 4: Reliance Infrastructure, an Anil Ambani group company, today entered the defence business by acquiring Pipavav Defence and Offshore Engineering.

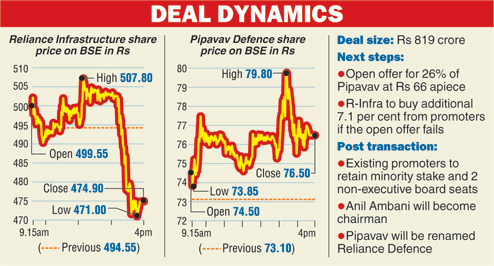

To begin with, Reliance Infrastructure and its wholly owned subsidiary Reliance Defence Systems will acquire from the promoters of Pipavav Defence around 13 crore equity shares, representing an 18 per cent stake in the company, at a price of Rs 63 per share, aggregating Rs 819 crore.

Following this acquisition, Reliance Defence Systems will make an open offer to acquire 26 per cent shares from the minority shareholders of the company at a price of Rs 66 per share. The open offer will seek to mobilise up to 19.14 crore shares, which will add up to a total consideration of Rs 1,263 crore.

However, according to an agreement between Reliance Infrastructure and the promoters of Pipavav, the former will also acquire additional Pipavav shares at the same price of Rs 63 per share so as to ensure that its shareholding is not less than 25.10 per cent after taking into account the acquisitions made under the open offer.

A statement by Reliance Infrastructure added that after the transaction, the existing promoters of Pipavav Defence will continue to retain a minority stake in the company and appoint two non-executive members to the board

According to a letter to the bourses, the current promoter stake in Pipavav Defence will come down to 24.60 per cent from 42.26 per cent.

After the completion of the transaction, Anil Ambani, chairman of Reliance ADAG, will become the chairman of Pipavav Defence.

Commenting on the transaction, Ambani said, "This is a unique opportunity for Reliance Group to participate in Prime Minister Narendra Modi's 'Make in India' programme for the high growth defence sector."

"We are confident that our strategic investment will create long-term value for all stakeholders," he said.

Nikhil Gandhi, the founder promoter and chairman of Pipavav Defence, said: "Aside from the commonality of vision, we share a philosophy of long-term value creation for all stakeholders."

The acquisition of Pipavav Defence will not only give Reliance Infrastructure access to the defence business but also a presence in ship building.

Pipavav, which is an integrated defence production, ship building and offshore infrastructure company, has a licence and contracts to build frontline warships for Indian Navy.

Pipavav Defence has one of the world's largest infrastructure facilities - spread over 841 acres of land on the Gujarat coast.

It owns one of the world's largest dry docks, measuring 662 metres in length and 65 metres in width.

Reliance Infrastructure develops projects through various special purpose vehicles (SPVs) in sectors within the infrastructure space that include roads, metro rail and cement. It is also an utility company, having a presence across the value chain of power businesses - generation, transmission, distribution and power trading.

However, the open offer price comes at a discount of nearly 14 per cent to the closing price of the Pipavav stock on the bourses today.

On the BSE, the share ended with gains of around 5 per cent at Rs 76.50, in an otherwise weak market that saw the Sensex ending lower by 213 points.

Shares of Reliance Infra today were 4 per cent down at Rs 474.90 on the Bombay Stock Exchange.

In acquiring Pipavav Defence, Reliance Infrastructure will pip suitors like the Munjal family and Mahindra & Mahindra who were reportedly keen to buy the company.