|

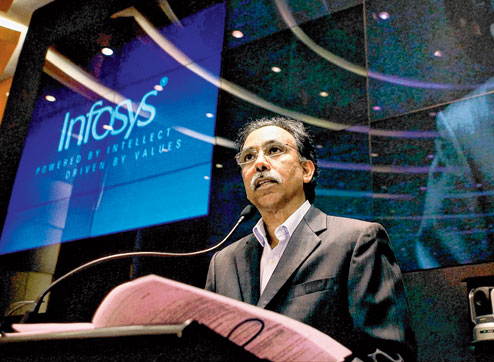

| Infosys Technologies CEO SD Shibulal announces the Q4 results of the company in Bangalore on Friday. (PTI) |

Mumbai, April 12: The Infosys scrip crashed on stock exchanges today after the country’s second-largest software exporter came out with lower-than-expected revenue guidance for the current financial year while announcing its fourth-quarter financial results.

There is now a growing feeling that the frequent sets of bad news coming from the Bangalore-based outfit is a sign that this could be due to company-specific issues and not entirely due to the difficult macro environment in markets such as the US and Europe.

The Infosys stock shed 21.33 per cent, or a whopping Rs 622.40, on the Bombay Stock Exchange to end at Rs 2295.45 with Rs 35,000 crore of its market cap being wiped out. This is the Bangalore-based company’s largest single day fall since 2003.

This huge fall in the Infosys scrip did lead to an important question as to why the company disappointed often when its peers like TCS and HCL Technologies have been reporting strong numbers.

“The commentary that we hear from other companies is that the demand environment is better than last time. Then why is not Infosys performing? It does lead to a feeling that there is some problem that is specific to Infosys,” an analyst said.

The meltdown in Infosys stock had a rub-on effect on the BSE Sensex that recorded its biggest single-day fall since late February.

The Sensex closed down for a second straight week, having fallen in six of the last eight trading sessions. The index lost 1.1 per cent this week, with foreign investors offloading stocks.

Concerns about the economic outlook and political stability have sparked a sell-off in shares. Data on Friday showed sluggish industrial output, although a separate report showing slowing consumer inflation raised hopes the central bank may cut interest rates next month.

Those hopes lifted banking shares such as ICICI Bank, although the gains were not enough to offset steep falls in technology stocks following the Infosys results.

“Monday’s inflation figure’s influence on RBI policy and earnings would decide the near-term trend. Expectations were very high and therefore such a big reaction has come,” said a market observer.

The 30-share Sensex closed down 1.62 per cent, or 299.64 points, at 18,242.56, posting its biggest single-day fall since February 26.

The 50-share Nifty ended down 1.17 per cent, or 65.45 points, at 5,528.55, and posting a 0.44 per cent fall for the week.