|

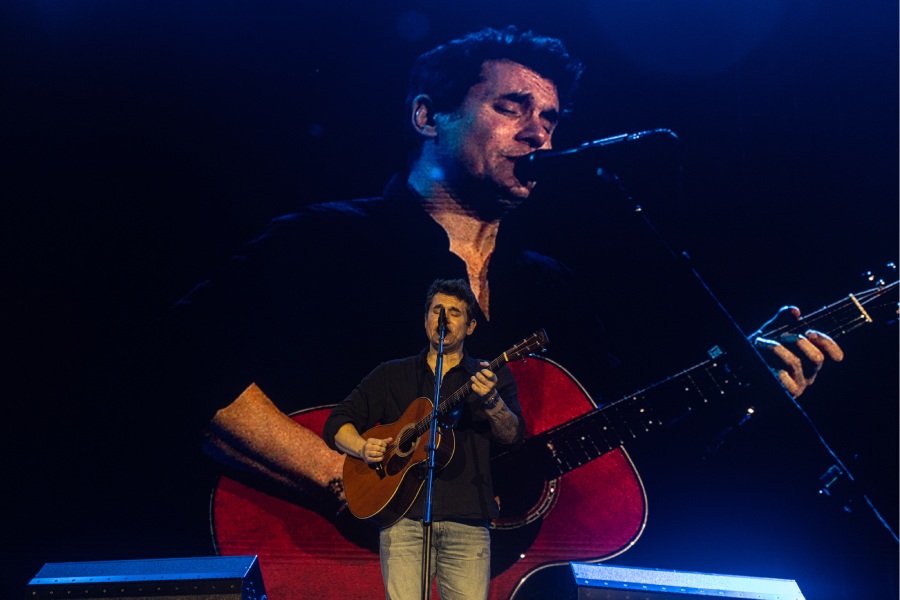

| Odisha finance minister Prasanna Acharya (second from left) attend a meeting of the Empowered Committee of Finance Ministers chaired by Sushil Modi (third from left) in Bhubaneswar today. Telegraph picture |

Bhubaneswar, Jan. 28: States can expect a compensation to the tune of Rs 34,000 crore from the Centre for the losses incurred by them on account of reduction in Central Sales Tax (CST) in the last three years.

The Empowered Committee of Finance Ministers from the states, which met here today, gave it a nod to the Centre’s suggestion in this regard. The amount will be paid to compensate the loss of the states because of the introduction of VAT (Value Added Tax).

While 13 states have sent their finance ministers, the remaining states are being represented by officials at the two-day meet.

Chairperson of the panel and Bihar deputy chief minister Sushil Kumar Modi told reporters that states would be paid 100 per cent of the loss suffered because of the reduction of the CST for the 2010-11 financial year. For subsequent financial years, the amount rates will come down. The Centre will pay 75 per cent of loss claimed by the state for 2011-12 while it will be 50 per cent of the claim made by the states for 2012-13.

On a rough estimate, the states are expected to get around Rs 34,000 crore compensation for the last three years, but the modalities of the payment will be decided later.

Modi was keen that the Centre defined the time table and the mechanism of payment. “This is important, so that, we don’t have to go to them with a begging bowl repeatedly,” said Modi. The Bihar stalwart had yesterday made a strong pitch for both his state and Odisha being given the special category state status by the Centre in view of their poverty and backwardness.

As it is, the states are demanding 100 per cent relief for the loss as they feel that the implementation of the Goods and Services Tax GST, which was to replace CST, was delayed as the bill for its introduction had been pending in Parliament. It was, they argue, no fault of theirs.

But still, the Centre expressed its inability to meet the demand of the states owing to its current financial position.

Odisha finance minister Prasanna Kumar Acharya said the cumulative loss suffered by the state was to the tune of around Rs 1,500 crore. “We hope to get Rs 1,000 crore as compensation,” said Acharya.

The Centre had taken the decision to introduce the GST from April 2010 when P. Chidambaram was the finance minister. An empowered committee consisting of all finance ministers of the states was formed to chalk out a strategy for the purpose. According to the strategy, the CST will be reduced in phases from 4 per cent to 3 per cent in the first year, to 2 per cent in the second year and then to zero.

Arguing that the Centre should compensate the loss suffered by the states because of the CST reduction, Modi said the central government had paid the compensation to the states for the first three years from 2007 to 2010.

However, in 2011, the states got Rs 6,000 crore towards the relief against their demand of Rs 19,000 crore. Later, the Centre pleaded its inability to compensate the states.

It was pointed out that the GST could not be implemented in 2010 because of a variety of reasons. A bill to introduce the GST came up for consideration in Parliament in 2011 and was referred to the parliamentary standing committee of finance. It is pending with the committee for the past two years.

In the process, the states continue to suffer losses. The loss was particularly high for states such as Gujarat, Odisha, Andhra Pradesh, Bengal and Haryana where a large number of mineral-based manufacturing units were located.

While 13 states — Gujarat, Assam, Jammu and Kashmir, Chhattisgarh, Karnatak, Madhya Pradesh, Bengal, Punjab, Bihar, Tamil Nadu, Odisha, Delhi and Haryana — are led by their finance ministers, the other states are represented by their officials.