Guwahati: The credit-deposit ratio (CDR) of all scheduled commercial banks in Assam came down to 39.9 per cent in 2017 from 41.1 per cent in 2016 despite banks' expansion in the state and local demand to rev up the CDR for small borrowers.

Economic Survey, Assam 2017-18, revealed that aggregate deposits in the banks rose to 17.8 per cent till March 2017, compared to 6.6 per cent growth the previous year. Growth of the bank credit, on the other hand, was found to be 14.3 per cent during the year, compared to 18.8 per cent in 2016.

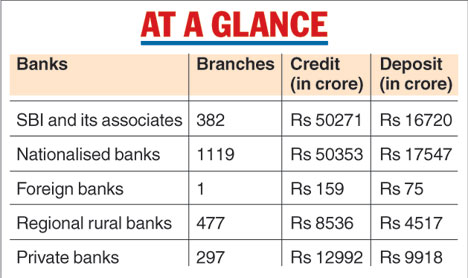

It said the CDR in Assam was far below the national average of 73.7 per cent in all scheduled commercial banks. The survey found that 2,276 offices of all scheduled commercial banks in the state reported deposits of Rs 122,311 crore against their credit of Rs 48,777 crore till March 2017 ( see chart).

The CDR in Assam in 2008 was 41.2 per cent against the national figure of 74.2 per cent. This came down to 36.9 per cent in 2015 compared to average 77.4 per cent in the country.

The expansion of banking facilities in the state over the years has resulted in volume of deposits and also disbursement of credit. The aggregate deposit has increased to Rs 122,307 crore in March 2017, which was 17.84 per cent more than in the previous year.

The per capita deposit in the state has also been increased from Rs 33,267 in March 2016 to Rs 39,201 in March 2017 which was 17.84 per cent more compared to the previous year, said the survey report which was tabled in the Assembly during the budget session, which concluded on Friday.

Disbursement of credit saw 14.31 per cent growth from Rs 48,776 crore till March 2017 from Rs 42,671 crore in 2016, but the scheduled commercial banks in Assam shared only 0.62 per cent of the total credit disbursed in the country in 2017.

The per capita credit increased to Rs 15,633 from Rs 13,677 in 2016 but the low CDR continued to be a worry for economists and local organisations calling for further push to credits, particularly to small borrowers to boost rural and small town economy.

Of the 2,276 offices of different banks in Assam till March 2017, 46 per cent are located in rural, 28 per cent in semi-urban and 26 per cent in urban areas.