The gradual lifting of Covid restrictions by China and expectations of the US Fed going slow on rate hikes spurred a stock rally in Asia — with the buoyancy reaching India and hoisting the benchmark Sensex and Nifty by nearly 2 per cent.

The combination of positive global cues coupled with gains in Reliance Industries and the IT stocks resulted in the Sensex spurting 1041.08 points, or 1.90 per cent, to end at 55925.74, while the Nifty shot up 308.95 points to settle at 16661.40.

The strong start to the week came as data from the US showed inflation moderating to 6.3 per cent in April from 6.6 per cent in March. The American personal consumption expenditures (PCE) price index rose 0.2 per cent in April down from 0.9 per cent in March.

Core PCE, or core inflation, which the US Fed tracks closely, fell to 4.9 per cent against 5.2 per cent in March.

Analysts feel the US Federal Reserve which was in an aggressive rate hike mode to control inflation may slow down the pace to avoid recession. They expect hikes at the next two Fed meetings and moderation thereafter.

These factors led to investors evading safe havens such as the US dollar and treasuries in favour of riskier avenues such as stocks. The US dollar Index was trading at a one-month low of 101.60, while the yields on the US 10-year treasury note softened to 2.745 per cent.

Back home, reports of an early arrival of monsoon led to optimism of inflation cooling down from 8-year highs.

“The Indian markets witnessed a smart rally on the back of positive global cues and early arrival of monsoon giving hopes of a slowdown in inflation,” Siddhartha Khemka of Motilal Oswal Financial Services said.

“Though the markets have bounced back, inflation and central banks action globally would hold the key for the sustenance of this momentum.”

Meanwhile, the M&M share hit a 52-week high of Rs 1011.45 in intra-day trades as the utility vehicle major declared better than expected quarterly numbers over the weekend. At the BSE, the M&M scrip ended at Rs 997.90-a gain of 4.69 per cent over the previous close.

Analysts warned oil prices could halt the rally. On Monday, crude climbed to a two-month high of $120 a barrel ahead of an EU meeting to discuss sanctions against Russia and China emerging out of a lockdown.

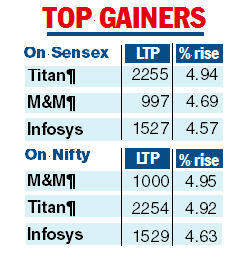

While the US markets are closed Monday on account of Memorial Day, Asian indices ended with gains of up to 2.19 per cent. Titan led the gainers list in the Sensex pack as it spiked 4.94 per cent.

It was followed by Mahindra & Mahindra, Infosys, Larsen & Toubro, Tech Mahindra and HCL Technologies which gained up to 4.69 per cent.

The broader markets were also strong with the Nifty mid-cap 100 index rising 2.42 per cent and the Nifty small-cap 100 index by 3.08 per cent.