Global alternative asset firm TPG has bought a 0.93 per cent stake in Jio Platforms for Rs 4,546.80 crore, while L Catterton, one of the world’s largest consumer focused private equity firms, has put in Rs 1,894.50 crore for a 0.39 per cent holding.

Both the investments value Jio Platforms at an equity value of Rs 4.91 lakh crore and an enterprise value of Rs 5.16 lakh crore.

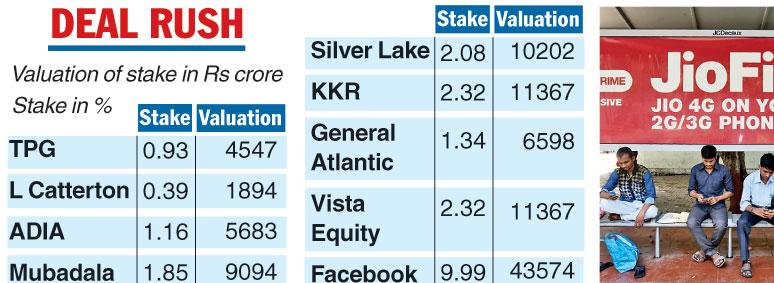

With these deals, Jio Platforms has raised Rs 1.04 lakh crore from 10 deals in seven weeks from global technology investors, including Facebook, Silver Lake, Vista Equity Partners, General Atlantic, KKR, Mubadala and Abu Dhabi Investment Authority (ADIA).

Sources close to RIL said the deals are another strong endorsement of Jio’s tech capabilities, disruptive business model and long-term growth potential. They added that the investments further reaffirms Jio’s continuing attraction among global investors.

“We have been impressed by TPG’s track record of investing in global technology businesses which serve hundreds of millions of consumers and small businesses, making the societies we live in better,” said Mukesh Ambani, chairman and managing director of RIL.

TPG is a leading global alternative asset firm founded in 1992 with more than $79 billion of assets under management.

TPG’s investments in global technology companies include Airbnb, Uber, and Spotify, among others.

“We are excited to partner Reliance to invest in Jio... we are excited to play an early role in Jio’s journey as they continue to transform and advance India’s digital economy,” said Jim Coulter, co-CEO of TPG.

L Catterton

Founded in 1989, L Catterton has successfully invested in some of the most innovative brands at the forefront of the evolving consumer landscape, including Peloton, Vroom, ClassPass, Owndays and FabIndia. L Catterton was formed through the partnership of Catterton, LVMH, and Groupe Arnault.

Ambani said: “I look forward to gaining from L Catterton’s invaluable experience in creating consumer-centric businesses because technology and consumer experience need to work together to propel India to achieving digital leadership.”

Michael Chu, global co-CEO of L Catterton, said, “Over our more than 30-year history, we have established a track record of building many of the most important brands across all consumer categories and geographies. We look forward to partnering with Jio.”