Jet Airways has obtained shareholders’ approval for various proposals that include the conversion of bank loans into equity.

The development, though expected, should come as a relief for the crisis-hit airline, which can now look forward to an immediate cash infusion from lenders.

The full-service carrier on Friday disclosed the outcome of the voting for five resolutions that were put up for shareholder approval at an extraordinary general meeting (EGM) held on Thursday.

Of these, one of the resolutions was to increase the authorised share capital (consisting of 18 crore equity shares of Rs 10 and two crore preference shares each) from Rs 200 crore to Rs 2,200 crore. This will consist of 68 crore shares and 152 crore preference shares.

Another proposal was to convert either outstanding loans or fresh borrowings from banks into shares, convertible instruments or any other securities. Over 97.86 per cent of the shareholders voted in favour of this plan.

Source: The Telegraph

Similarly, the proposal to raise the authorised share capital and consequent alteration to the share capital clause of the memorandum of association saw 97.99 per cent votes being polled in favour.

Another resolution for alteration of the articles of association of the company was also cleared with the requisite majority as 97.9906 per cent of the shareholders voted in its favour. Two other proposals received support from 99.99 per cent of the shareholders who cast their votes.

It is believed that lenders led by the State Bank of India (SBI) are likely to infuse funds into Jet Airways after it secures the nod from shareholders.

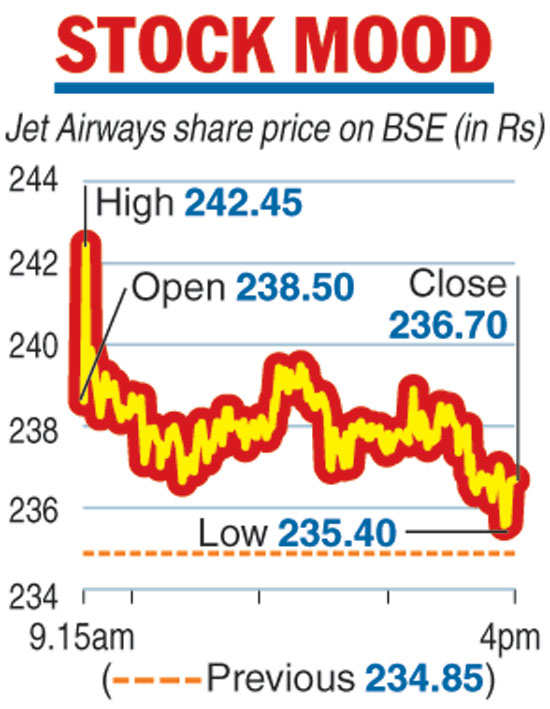

Shares of Jet Airways on Friday settled with gains of 0.79 per cent at Rs 236.70 on expectations that the company would announce emergency cash infusion by banks after the announcement of the EGM results.

Bloomberg had earlier reported that Jet Airways could get up to Rs 600 crore from lenders such as the SBI. The gains in the counter came on a day when the benchmark index finished 27 points lower.

Jet Airways, which recently gave some details of the bank-led resolution plan, had disclosed that there is a funding gap of Rs 8,500 crore. Banks will get around 50 per cent stake in the full-service carrier for an aggregate consideration of Re 1. The airline will issue 11.40 crore shares to banks. Consequently, the holding of founder Naresh Goyal will come down to 25 per cent and that of Etihad to 12 per cent from 24 per cent now.

However, the shareholding structure could change after a likely rights issue.