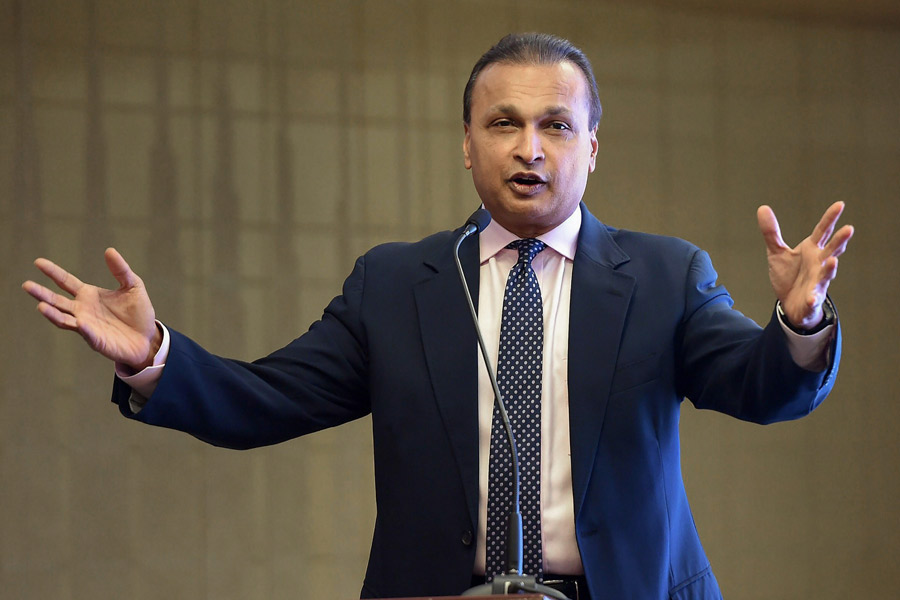

India's market regulator has rejected a plea by industrialist Anil Ambani to settle charges related to investments in lender Yes Bank, potentially exposing him to at least a 18.28 billion rupee ($208.4 million) penalty, according to documents reviewed by Reuters.

The case relates to 21.5 billion rupees ($245.3 million) invested by Ambani' Reliance Mutual Fund between 2016-2019 in Yes Bank's additional tier-1 bonds, which were written-off when the bank was declared insolvent in 2020.

Reliance Mutual Fund was sold to Nippon Life Insurance in 2019 and charges pre-date the sale.

The Securities and Exchange Board of India (SEBI) in its investigation said the investment was made in exchange for loans from Yes Bank to other Anil Ambani group companies, according to regulatory notice.

Rejecting Ambani's pleas to settle the charges without admitting guilt, the regulator said on July 7 that the fund's conduct caused a loss of investor wealth of 18.28 billion rupees and had a 'market wide impact'.

Anil Ambani - the younger brother of billionaire Mukesh Ambani - is facing renewed scrutiny of dealings between his firms and Yes Bank, which was declared insolvent in 2020 and rescued by a group of lenders in a plan approved by the central bank.

Last month, India's top crime fighting agency searched locations linked to the group as part of a scheme to siphon off 30 billion rupees in loans from Yes Bank, Reuters reported.

A proposal by Anil Ambani, his son Jai Anmol Ambani, and former Yes Bank chief executive Rana Kapoor to settle has not been accepted.

SEBI has informed Ambani and his son that it will pass directions asking them to compensate the investors, documents showed. Additional action could include monetary penalties, documents showed.

"SEBI has also shared its findings with Enforcement Directorate," two sources with direct knowledge of the matter said.

The rejection of settlement, possible regulatory action and SEBI sharing its findings with Enforcement Directorate have not been previously reported.

Email queries sent to SEBI and Ambani on Monday were not answered. A message sent to Rana Kapoor's last known phone number was not answered.

SEBI in its investigations found Ambani influenced investment decisions made by Reliance Mutual Fund.

"It is alleged that Anil Ambani and Jai Anmol Ambani had infleunce and control over Reliance Mutual Fund investment in Yes Bank's additional tier-1 bonds through Sundeep Sikka, chief executive of the fund house and chief investment officer." SEBI said.

The notice cites meetings between Ambani and fund house executives at the time of the said invesments. It also cited emails where Kapoor characterised investments into Reliance Group entities as 'bilateral relationship deal'.

The SEBI notices have also charged the fund house, its chief executive, chief invetsment officer and former chief risk officer for alleged losses to investors.

These four have filed a separate settlement application equalling 950 million rupees. These are still under consideration, the two sources said.

"There were lapses and non-compliance in adherence with the laid down internal policy and procedure and also bypassing the internal risk/ control framework while enhancing the sub-limit and making the investment," SEBI documents said.

Email sent to a spokesperson for Nippon Mutual Fund was not answered.