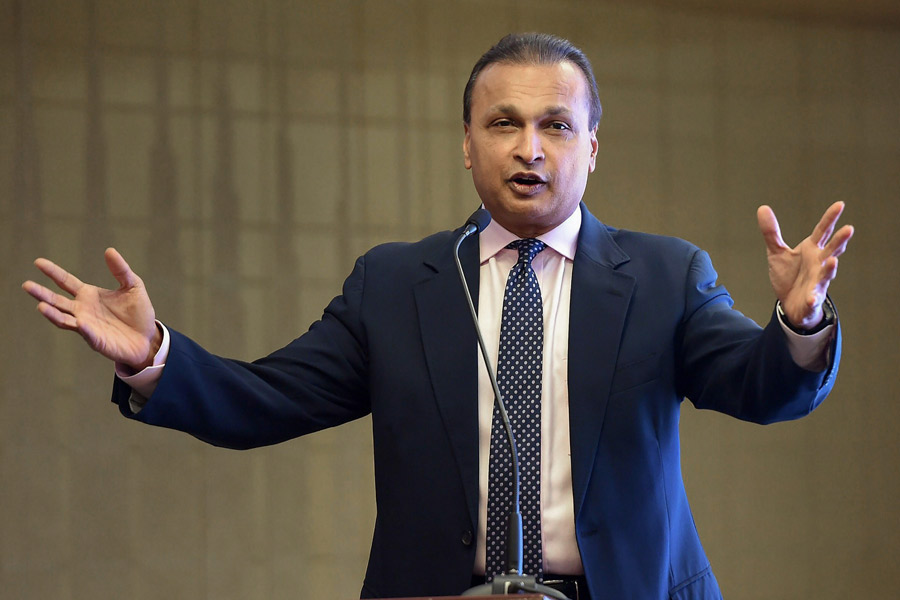

The Enforcement Directorate on Friday issued a lookout circular against Reliance Group Chairman Anil Ambani in connection with a suspected Rs 3,000 crore loan fraud and money laundering case, reports NDTV.

Anil Ambani can now no longer travel outside India without court permission. It is circulated to all entry and exit points, including airports and seaports, and officials are alerted to detain individuals against whom such notices are issued if they try to go out of the country.

This comes after a series of crackdowns on his business entities, allegations of fraud against his firms, and a summons issued by the federal agency.

Earlier in the day, ED has summoned Ambani for questioning on August 5 in a money laundering case linked to bank loan fraud worth crores of rupees against his group companies, official sources said on Friday.

Ambani, 66, has been asked to depose at the ED headquarters in Delhi as the case has been registered here, the sources said.

The agency will record his statement under the Prevention of Money Laundering Act (PMLA) once he deposes, they said.

Some executives of his group companies have been also been summoned over the next few days.

The summons come after the federal agency conducted searches at 35 premises of 50 companies and 25 people, including executives of his business group, last week. The searches, launched on July 24, went on for three days.

The action pertains to alleged financial irregularities and collective loan "diversion" pegged at more than Rs 17,000 crore by multiple group companies of Anil Ambani, including Reliance Infrastructure (R Infra).

The agency found, on the basis of a Sebi report, that R Infra "diverted" funds disguised as inter-corporate deposits (ICDs) to Reliance Group companies through a company named CLE. It is alleged that R Infra did not disclose CLE as its "related party" to avoid approvals from shareholders and audit panels.

An spokesperson for the Reliance Group, in a statement, said the allegation regarding alleged diversion of Rs 10,000 crore to an undisclosed party was a 10 years old matter and the company had stated in its financial statements that its exposure was only around Rs 6,500 crore.

Reliance Infrastructure (R Infra) had publicly disclosed this matter on February 9, 2025, nearly six months ago, the statement said.

"Through mandatory mediation proceedings conducted by a retired Supreme Court judge and the mediation award filed before the Hon'ble Bombay High Court, Reliance Infrastructure arrived at a settlement to recover its 100 per cent exposure of Rs 6,500 crore," it said.

The company added that Anil Ambani was not on the Board of R Infra since more than three years (March 2022).

The ED is also looking at allegations of "illegal" loan diversion of around Rs 3,000 crore, given by the Yes Bank to the group companies of Ambani between 2017-2019.

The ED, the sources said, has found that just before the loan was granted, Yes Bank promoters "received" money in their concerns.

The agency is investigating this nexus of "bribe" and the loan.

The sources said the ED is also probing allegations of "gross violations" in Yes Bank loan approvals to these companies, including charges such as back-dated credit approval memorandums and investments proposed without any due diligence/credit analysis in violation of the bank's credit policy.

The loans are alleged to have been "diverted" to many group companies and "shell" (bogus) companies by the entities involved.

The agency is also looking at some instances of loans given to entities with weak financials, a lack of proper documentation of loans and due diligence, borrowers having common addresses and common directors in their companies, etc., the sources said.

The money laundering case stems from at least two CBI FIRs and reports shared by the National Housing Bank, SEBI, National Financial Reporting Authority (NFRA) and Bank of Baroda with the ED, they had said.

These reports, the sources said, indicate that there was a "well-planned and thought after scheme" to divert or siphon off public money by cheating banks, shareholders, investors and other public institutions.

The Union government had informed the Parliament recently that the State Bank of India has classified RCOM along with Ambani as 'fraud' and was also in the process of lodging a complaint with the CBI.

A bank loan "fraud" of more than Rs 1,050 crore between RCOM and Canara Bank is also under the scanner of the ED apart from some "undisclosed" foreign bank accounts and assets, the sources said.

Reliance Mutual Fund is also stated to have invested Rs 2,850 crore in AT-1 bonds, and a "quid pro quo" is suspected here by the agency.

Additional Tier 1 (AT-1) are perpetual bonds issued by banks to increase their capital base, and they are riskier than traditional bonds, having higher interest rates.

(With input from agencies)