The beleaguered rupee started on the same note as last week and fell 30 paise to close at a record low of 74.06 against the dollar, despite crude prices falling below $83 per barrel.

This fresh fall in the currency came as yields on US bonds hit seven-year highs, leading to the strengthening of the greenback against other currencies. Moreover, the domestic unit has been hit by steady foreign portfolio outflows.

Provisional data from the NSE showed that foreign portfolio investors were net sellers to the tune of over Rs 1,800 crore on Monday. So far this calendar year, foreign investors have sold more than Rs 75,000 crore in stocks and bonds.

“The rupee continued to remain under pressure, weighed down by a further rise in long-term US Treasuries following non-farm payroll data. US 10-year yield jumped to a fresh 7-year high after unemployment rate fell to lowest in 49 years. There has been some respite from crude as Brent has cooled down to $82.89 odd levels from the four day’s high of 86.74. However, the impact of the falling prices in crude was not seen on the rupee mainly because of a strong dollar index and high US bond yield,” V.K. Sharma, head of private client group & capital market strategy at HDFC Securities, said.

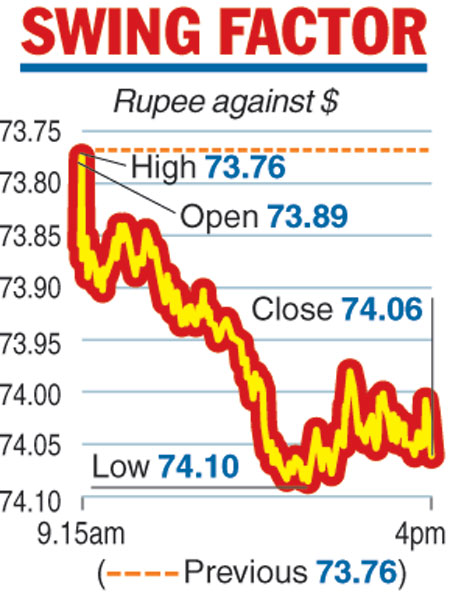

On Monday, the rupee opened lower at 73.89 against the previous close of 73.76 as the dollar gained against major global currencies. Though it recovered to a high of 73.76, it could not build on the gains and breached the 74 mark to touch a low of 74.10 to the greenback. It later settled at 74.06, lower by 30 paise.

Sensex recovers

There was some respite in the equity markets where the Sensex finished with gains of 97.39 points to end at 34474.38. Similarly, the broader Nifty rose almost 32 points at 10348.05. The session was, however, marked by volatility as stock prices reacted to the rupee remaining under pressure even as buying was seen in the last 45 minutes of trade. This was reflected in the Sensex, which gyrated 662 points both ways.

While market circles feel that stocks will react to global developments and the rupee, the results season which will start this week could also have some bearing in the near term.

The Telegraph