Billionaire Mukesh Ambani’s Reliance Industries on Friday posted a flat growth in net profit in the September quarter after a newly introduced windfall profit tax and lower refining margins dented earnings in the mainstay oil business.

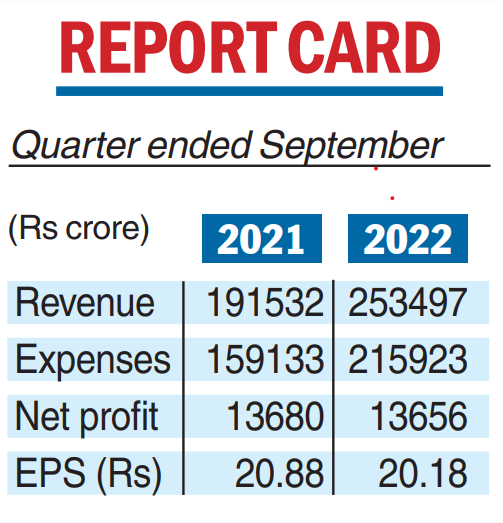

The oil-to-retail-to-telecom conglomerate’s consolidated net profit at Rs 13,656 crore in July-September was almost unchanged from Rs 13,680 crore net earnings in the same period last year, according to a company statement.

Sequentially, net profit fell 24 per cent from Rs 17,955 crore in April-June.

This is primarily because the firm’s mainstay oil-to-chemicals (O2C) business earnings were hit by a new tax that the government imposed on the export of diesel, petrol and ATF from July 1.

The government slapped a tax on the export of fuel as well as crude oil produced domestically to take away gain accruing from the spurt in global energy prices following the war in Ukraine.

The day was saved by a record rise in consumer-facing telecom and retail businesses as well as earnings from natural gas production.

But for the windfall profit tax, the net profit would have been 20 per cent higher.

The windfall profit tax cost the company Rs 4,039 crore in the quarter, lowering pre-tax earnings from the O2C business by almost 6 per cent to Rs 11,968 crore.

The O2C earnings also fell because of lower refining margins and the company’s oil refinery taking a planned maintenance shutdown during the quarter, lowering the output.

This was offset by a 27 per cent jump in the net profit of its digital arm Jio Platforms to Rs 4,729 crore and a 51 per jump in pre-tax earnings from the retail business of Rs 4,404 crore. The firm’s revenues from oil and gas production rose to Rs 3,171 crore.

This is the first quarterly dip in profit that the company has reported since January-March.

Consolidated EBITDA came in at Rs 38,702 crore, without including the impact of a windfall tax, and at Rs 34,663 crore after accounting for the new levy. Revenue increased 32.4 per cent to Rs 253,497 crore. EBITDA was up 14.5 per cent year-on-year.

Mukesh D Ambani, chairman and managing director, said the quarter saw record performance in the company’s consumer businesses.

“We saw consistent net subscriber additions and higher engagement in the digital services segment. Jio has announced a beta trial for its standalone 5G services,” he said.

The retail business delivered record performance with a strong revival in footfalls, store additions and digital integration, he noted.

“Performance of our O2C business reflects subdued demand and weak margin environment across downstream chemical products. Transportation fuel margins were better than last year but lower sequentially,” he said.

“Segment performance was also impacted by the introduction of special additional excise duties (windfall profit tax) during the quarter to ensure stable supply and lower volatility in the domestic market.”

Reliance Jio saw continued to see an uptick in per-user revenue — Rs 177.2 per subscriber per month in Q2.

Jio Financial Services to be listed

Mumbai: Reliance Industries Limited on Friday said it will demerge its financial services arm and list it on the stock exchanges.

In a statement, the firm said Reliance shareholders will be issued one equity share of Jio Financial Services Ltd (JFSL) for every share they hold in the company.

JFSL plans to launch consumer and merchant lending business while continuing to evaluate opportunities in insurance, asset management and digital broking segments, a Reliance statement said.

“The board of directors of Reliance Industries (RIL), at its meeting held today (Friday), approved a Scheme of Arrangement amongst RIL, Reliance Strategic Investments Limited (RSIL) and their respective shareholders and creditors in terms of which, RIL will demerge its financial services undertaking into RSIL (to be renamed Jio Financial Services Limited or JFSL),” it said.

JFSL would be listed on the Indian stock exchanges.

RSIL is currently a wholly-owned subsidiary of RIL and an RBI-registered non-deposit-taking systemically important non-banking financial company.

“Pursuant to the scheme, shareholders of RIL will receive one equity share of JFSL of face value Rs 10 for one fully paid-up equity share of Rs 10 held in RIL.”

Also, the investment of RIL in Reliance Industrial Investments and Holdings Limited (RIIHL), which is a part of the financial services undertaking of RIL, will stand transferred to JFSL.

PTI