Tokyo-based Mitsubishi UFJ Financial Group (MUFG) Bank will acquire a 20 per cent stake in non-banking finance company Shriram Finance Ltd (SFL) for ₹39,618 crore (around $4.4 billion), marking the largest cross-border investment in India’s financial services sector to date.

MUFG will acquire the stake through the issuance of preferential equity shares, SFL said in a statement. The signing of definitive agreements with MUFG Bank underscores confidence in the fundamentals and long-term growth prospects of India’s lending and financial services sector, the company said.

The SFL board has also approved granting MUFG the right to nominate up to two non-independent directors on its board that will lapse if MUFG’s stake falls below 10 per cent on a fully diluted basis, the company said in a stock exchange notification.

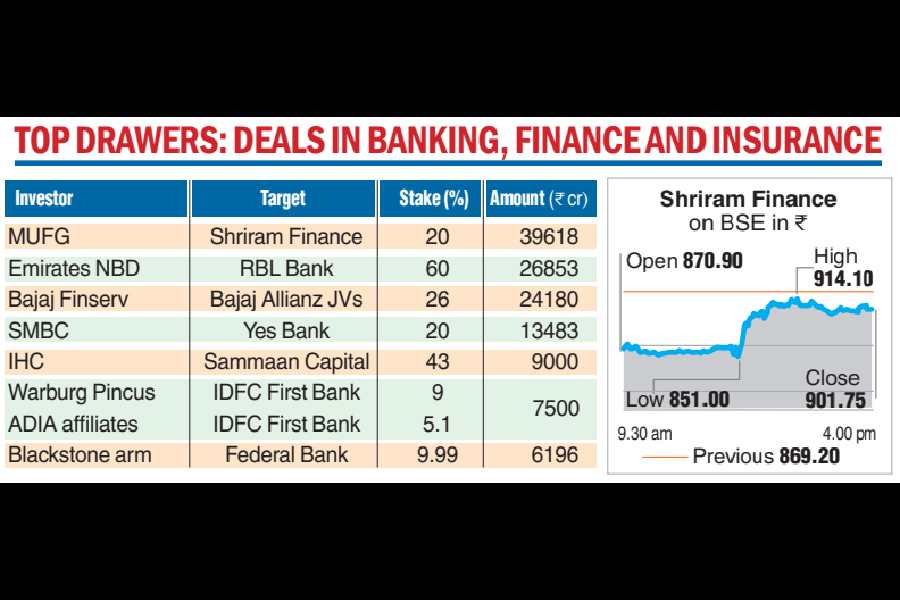

The scrips of SFL were up 3.74 per cent at ₹901.75 at the Bombay Stock Exchange on Friday.

SFL said the partnership combines its established domestic franchise and extensive distribution network with MUFG Bank’s global expertise and financial strength.

The fund infusion is expected to significantly enhance SFL’s capital adequacy, strengthen its balance sheet and provide long-term growth capital, accelerating its expansion plans.

The collaboration is also expected to unlock synergies in technology, innovation and customer engagement, driving sustainable growth. In addition, the partnership is likely to improve access to low-cost liabilities, potentially strengthening SFL’s credit ratings and align governance and operational practices with global best standards.

In FY25, the capital adequacy of the non-banking finance company, which offers commercial vehicle loans, MSME loans, tractors & farm equipment loans, gold loans, personal loans and working capital loans, was 20.68 per cent against the regulatory requirement of 15 per cent. Net profit for the year was ₹9,761 crore compared with ₹7,190 crore in FY24.

“The entry of MUFG as a key investor reinforces global confidence in India’s financial services sector and our role as a leader within it. Together, we aim to strengthen our capabilities, drive economic progress, and create meaningful impact across communities, building a future-ready institution anchored in trust and good governance,” said Umesh Revankar, executive vice-chairman, Shriram Finance.

“Leveraging our global capabilities, MUFG is committed to supporting Shriram Finance’s growth and contributing to economic development, communities and society in India,” said Hironori Kamezawa, group chief executive officer, MUFG.

Record deals

MUFG’s proposed investment in Shriram Finance trumps the previous biggest deal in the banking and financial services sector, where Emirates NBD Bank, the second-largest bank in the UAE, had expressed interest in acquiring a 60 per cent majority stake in RBL Bank for ₹26,853 crore. It marks a strong year of foreign investor interest in India’s financial services sector (see chart).

Between January and September 2025, mergers and acquisitions worth $8 billion had concluded across the financial sector, over 100 per cent increase from the same period last year, according to data by Grant Thornton.

Uday Kotak, founder and director of Kotak Mahindra Bank, said he is happy to see a reputed global bank investing in Shriram Finance in a big-ticket foreign investment. “Will Shriram continue as an NBFC which has huge potential without regulatory constraints of a banking company, or apply to become a bank in due course?” he observed in a social media post on X.

Restructuring

In a stock exchange notification, Shriram Finance also said that Shriram Capital, the holding company, is looking to restructure, to exclusively hold its lending business under one arm. Besides the non-bank lender, Shriram Capital holds other businesses like insurance, mutual fund, wealth advisory and retail stock broking.

The restructuring is only at a preliminary and exploratory stage. No final decision, commitment or approval has been taken by the board of Shriram Capital, the notification said.