However, IBBI pointed out that 75 per cent of the cases ending in liquidation (283 out of 378) were earlier with the BIFR or defunct and the economic value of most of these debtors had been eroded before they were admitted into CIRP.

On the resolution of 12 large accounts first initiated by the banks as directed by the Reserve Bank of India, they had an outstanding claim of

Rs 3.45 lakh crore. Of these, the resolution plan of six debtors have been approved. While the insolvency process had to be restarted for Amtek Auto because of the failure to implement the resolution plan, other accounts are at different stages of the process.

Of the total of 1,858 cases admitted, a bulk (772) came from the manufacturing sector.

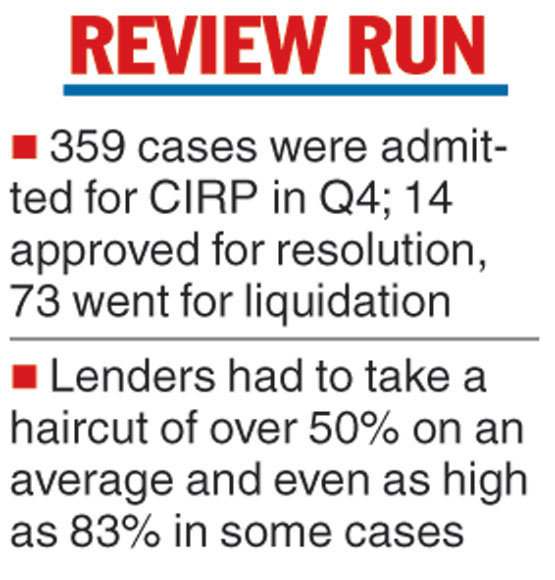

Kotak Securities, which analysed the numbers, said based on available data for all the 94 cases resolved under the insolvency resolution process till the March quarter, financial creditors have faced a haircut of around 52 per cent on the admitted claims.

The brokerage added that the haircut on the resolved cases during the period was high at 90 per cent (barring Essar Steel) but this was owing to an 83 per cent haircut that banks had to take for Alok Industries.

The implementation of the Insolvency and Bankruptcy Code (IBC) may have given banks a major tool to deal with bad loans, but the latest numbers show only a 13 per cent resolution, with lenders having to take an average haircut of over 50 per cent.

Numbers put out by the Insolvency and Bankruptcy Board of India (IBBI) show that 359 cases were admitted for the corporate insolvency resolution process (CIRP) during the January-March quarter, of which only 14 cases were approved for resolution and liquidation commenced for 73 debtors.

While it is a little more than two years since the provisions relating to the CIRP came into effect, the IBBI data showed that by the end of March 2019, the total number of cases admitted stood at 1,858. Of these, 152 have been closed on appeal or review or settled, while 91 have been withdrawn.

However, a large number — 378 — ended in liquidation with around 94 settling for a resolution plan. Thus, around 52.87 per cent of the cases were liquidated compared with 13.14 per cent ending with a resolution plan.

The Telegraph