Mumbai, Oct. 8: Shares of Reliance Industries Ltd (RIL) today cracked nearly 3 per cent on reports that a probe in its dispute over natural gas with state-owned ONGC was seen as turning against the company.

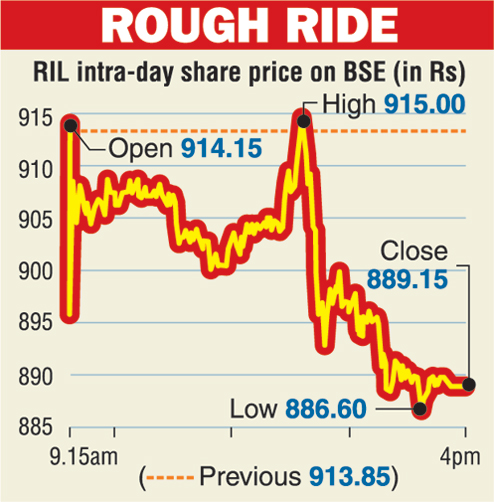

On the BSE, the RIL stock ended lower by 2.70 per cent, or Rs 24.70, to close at Rs 889.15.

On the NSE, shares of the company ended at Rs 889.10, down 2.7 per cent.

On the volume front, 2.94 lakh shares of the company changed hands on BSE and over 24 lakh shares were traded at NSE during the day.

The stock reacted after a television channel said a draft note from DeGolyer and MacNaughton (D&M) indicated that RIL had extracted 12-18 billion cubic metres (bcm) of gas from the reservoir of Oil and Natural Gas Corporation (ONGC) in the Krishna-Godavari block. RIL may have to pay Rs 12,000 crore as compensation to ONGC.

ONGC had filed a petition against RIL in the Delhi high court last year, alleging that "four wells have been drilled by respondent no. 3 (RIL) within 50-350 metres of the blocks of (the) petitioner (ONGC) and wells have been so drilled and constructed that there is a pre-planned and calculated slant/angular incline towards the gas reserves of (the) petitioner with a clear idea to tap the same".

ONGC said its nomination block Godavari PML (G4) and discovery block KG-DWN-98/2 (KG-D5) under New Exploration Licensing Policy (Nelp)-1 are contiguous with RIL-operated KG-DWN-98/3 (KG-D6).

RIL has maintained that it had followed the production sharing contract and had done no wrong. It has drilled all wells within its boundary walls.

Last month, the Delhi high court had rejected the petition and asked the parties to wait for the report by the independent expert (D&M). It allowed ONGC to approach the court again if the government did not act within six months of the submission of the report.

D&M was appointed by ONGC and RIL under the guidance of the directorate general of hydrocarbons.

While RIL officials did not comment today, sources close to the oil giant said it had not yet received the draft report from D&M.

Weakness in the RIL stock pulled down the company's market valuation by Rs 7,817.22 crore to Rs 2,87,944.78 crore today. On the volume front, 2.94 lakh shares of the company changed hands on the BSE and over 24 lakh shares were traded on the NSE during the day.