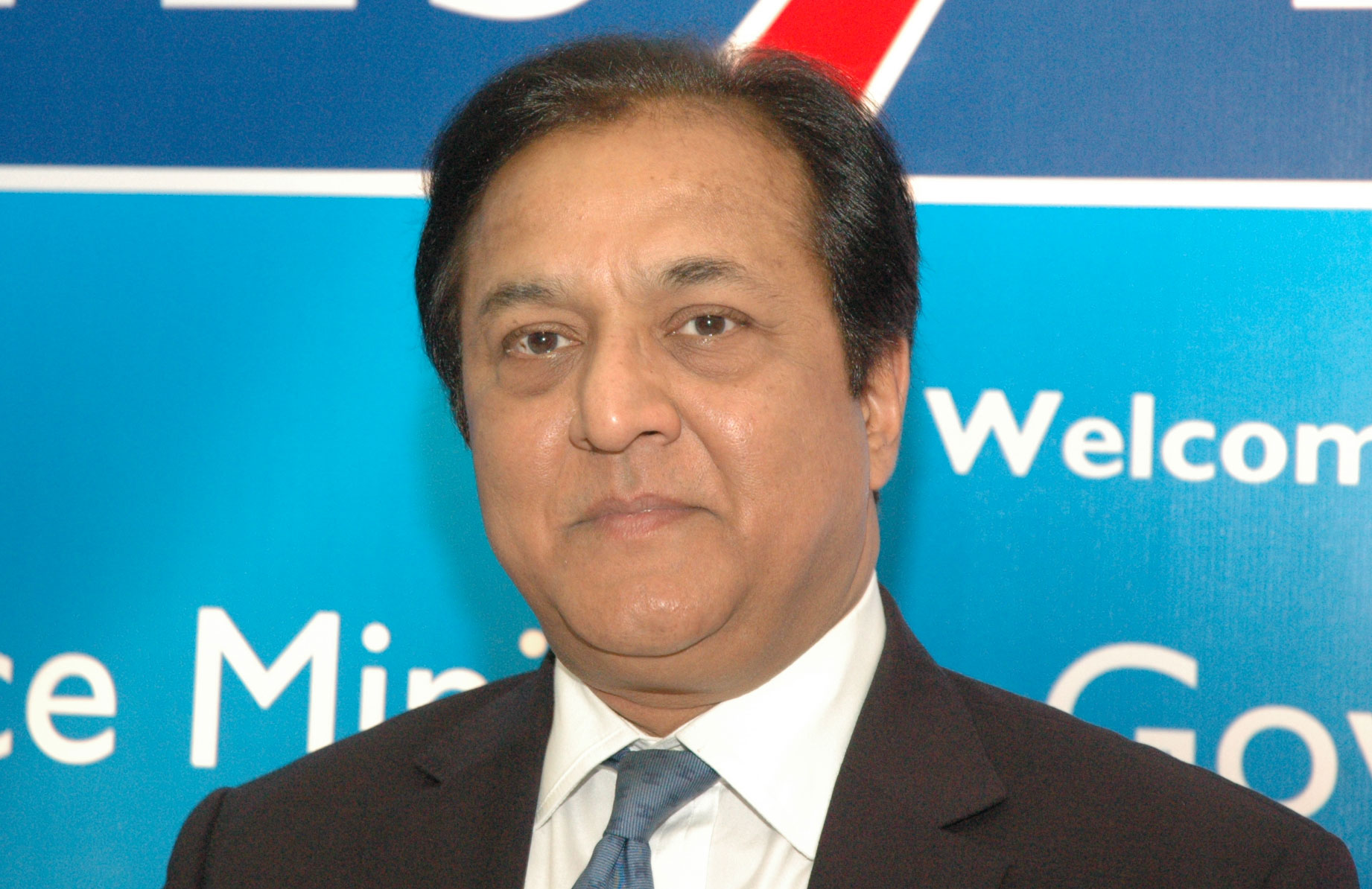

Brokerages feel the Reserve Bank of India’s (RBI) move to curtail the tenure of Yes Bank co-founder and CEO Rana Kapoor could throw up several challenges before the lender.

The RBI has communicated to the country’s fourth largest private sector lender that Kapoor can continue as the managing director & CEO only till January 31, 2019. Yes Bank had sought a three-year tenure for him, beginning September 1.

A couple of brokerages have already downgraded the stock based on the news and they are of the view that Kapoor’s exit could have some impact on the bank at least in the near term.

IDFC Securities, which has downgraded the stock to underperformer from neutral and cut the target price of the scrip to Rs 230 from Rs 350, feels the development is a “big negative” for Yes Bank.

“Kapoor was central to the bank’s business strategy. His absence will slow down loan and fee growth for the bank, which could lead to a sharp fall in valuations. It could also impact Yes Bank’s ability to raise high value deposits. More importantly, Yes Bank needs fresh capital given its strong loan growth, which will be difficult to raise after this event,’’ the brokerage said in a note.

It warned that since the risk of the RBI not approving Kapoor’s re-appointment had not yet been priced in by the Street, there could be a “significant correction” in the stock price.

Citi Research also downgraded the stock and cut the target price to Rs 270 from Rs 440. It felt there was a premium attached to the stock on account of Kapoor and this will now go away because of his exit. The brokerage also felt the bank may have to postpone its capital raising plans, which could slow growth.

Among other brokerages, Edelweiss, which maintained its buy rating, also cut the target price. The Yes Bank stock had closed at Rs 318.50 on the BSE on Wednesday.

Yes Bank made the announcement after market hours on Wednesday and observers are of the view the stock could come under pressure on Friday as the Street grapples with the impact of the move. Its board will meet on September 25 to decide the next course of action.

Meanwhile, Moody’s affirmed the ratings of the lender and maintained the stable outlook. “Yes Bank’s profitability is strong, and Moody’s expects that the bank can maintain low credit costs over the next 12-18 months,” it said in a note.