The benchmark index on Monday slid nearly 519 points and the rupee by 16 paise against the dollar on worries over global growth as various Fed officials made hawkish statements about interest rate hikes to quell inflation.

For equity investors, it was the third straight session where the key indices fell almost one per cent on weak global sentiment. The 30-share BSE Sensex declined 518.64 points or 0.84 per cent to settle at 61144.84 after crashing more than 604 points during intra-day trades to 61059.33. At the NSE, the broader Nifty fell 147.70 points or 0.81 per cent to end at 18159.95.

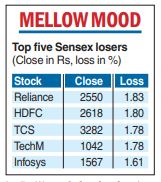

Reliance Industries was the top loser in the Sensex pack as it lost 1.83 per cent. It was followed by HDFC, Tata Consultancy Services, Tech Mahindra, Infosys, Bajaj Finance, Wipro and Tata Steel which slipped up to 1.80 per cent. However, Bharti Airtel, Axis Bank, IndusInd Bank, Hindustan Unilever and Power Grid were among the winners.

The poor opening came despite international oil benchmark Brent crude trading below the $90 per barrel mark at $86.82 per barrel. There have been concerns about global growth due to aggressive rate tightening by various central banks and rising Covid cases in China and travel curbs being imposed in Beijing. Sales by foreign portfolio investors also added to the investor’s worry. Provisional data showed them selling stocks worth Rs 1,600 crore on Monday.

“The sharp decline in crude prices is a huge positive for the domestic economy. However, the market did not respond favourably due to stronger headwinds from the global market. The prospect of a prolonged tightening cycle by the US Federal Reserve and the Chinese Covid restrictions affected the world market,” Vinod Nair, head of research at Geojit Financial Services, said.

In the broader market, the BSE midcap gauge dipped 0.15 per cent and smallcap index climbed marginally 0.01 per cent.

At the forex markets, the rupee ended with losses of 16 paise at 81.85 against the dollar in line with the strength of the American currency in global markets. The local unit opened weaker at 81.85 and fell to a day’s low of 81.90 and thereafter settled at 81.85 as Fed officials vowed to keep inflation below 2 per cent.