Chinese e-commerce giant Alibaba is in exploratory talks with Spencer’s to pick up a minority stake in the food and grocery retail chain.

The Jack Ma-promoted company joins the list of global players such as Amazon which are looking to beef up their brick-and-mortar presence in India in the footsteps of Walmart.

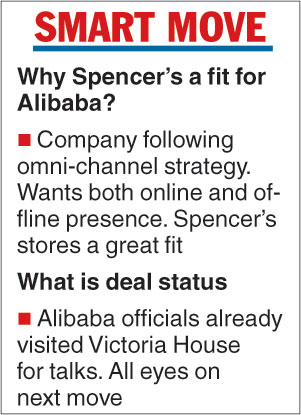

Alibaba representatives recently visited Victoria House, the headquarters of RP-SG Group that owns the hypermarket Spencer’s, to hold discussions.

Sources said the dialogue with both Alibaba and Amazon is “live” but it is unclear whether a deal would materialise with any one of them.

Sanjiv Goenka, chairman of RP-SG Group, declined to comment on the matter.

In the recent past, Alibaba is believed to have held discussions with Indian players such as Kishore Biyani’s Future Retail and Mukesh Ambani’s Reliance Retail for a possible alliance.

The Chinese major is pursuing an omni-channel, or multi-channel retail plan, having a presence both in offline (store level) and online platforms.

The company is already a significant shareholder in India’s online retailer Paytm Mall, online food and grocer BigBasket and online food delivery app Zomato.

Telegraph infographic

Amazon, the world’s largest online player, is pursuing the same strategy when it took control of loss-making More from the AV Birla group for around Rs 4,200 crore.

The multi-channel strategy had gained momentum when Walmart, the world’s largest brick-and-mortar retailer, picked up a 77 per cent stake in Indian e-commerce giant Flipkart for $16 billion. Foreign direct investment in multi-brand retail is allowed up to 51 per cent.

The demerger of Spencer’s from parent CESC Ltd, the flagship of RP-SG Group, will be handy if a transaction goes through.

The parent will have close to a 50 per cent stake in the listed entity as the demerger will be a mirror split, reflecting the existing shareholding pattern of CESC.

Market sources said Spencer’s is expected to fetch better valuation than More because the company is nearing break-even compared with the AV Birla outfit which was deep in the red.

Spencer’s is expected to close the year with a Rs 2,500-crore turnover and positive on profit before depreciation and tax.

It has 138 stores in 36 cities, spread mostly in the eastern, northern and southern parts of India.