Bhubaneswar, Nov. 21: Small traders, shopkeepers and vendors in the semi-urban areas of Kendrapara have turned to cashless transactions to keep their businesses running after the demonetisation move.

Small traders are rushing to banks with applications for point of sale (POS) electronic devices.

"Customers come to us with debit cards to buy goods. Before the demonetisations move, I had no idea about the POS device and electronic transfer of money through such devices but bankers have explained to me how it is done. I have submitted an application seeking installation of the machine and hope to receive it shortly," said Amit Mishra, a variety storeowner in the Paradip Port Township.

Banks have been flooded with requests from traders for these cashless devices.

"The demand for POS devices has gone up with high-value notes getting scrapped. Businessmen who have their current accounts in our bank are asking for POS devices every day. We do not have enough stock at our disposal to meet their growing demand. We are sending their applications to the head office in Bhubaneswar," said Kendrapara branch head of HDFC bank, Abinash Meher.

The machines, a bank manager said, come from the head offices of the banks after being configured to accept credit and debit cards. "Before the demonetisation move, the bank had supplied about one hundred POS devices to traders. Now, about 125 POS applications are pending with us. More are coming. The trend of traders opting for such transaction is a positive development. Sales will pick up and this will also ease the burden on banks," Meher said.

Punjab National Bank branch manager Manas Kumar Sahu said: "POS transactions are still new for people in rural pockets. They are yet to get used to it. But the prevailing cash crunch will familiarise them with the device as shopkeepers are going to use them now. It's a customer-centric measure through which people with debit cards and ATM cards can buy items from the shops."

Consumers, too, are responding positively. "All this while, I thought debit cards could only be used at ATM kiosks. However, the present crisis has made me more aware. I now use mine to buy goods at shops through POS devices. I was initially apprehensive but later, I found it was a hassle-free mechanism," said Rajendra Acharya, who hails from Rahama in Jagatsinghpur.

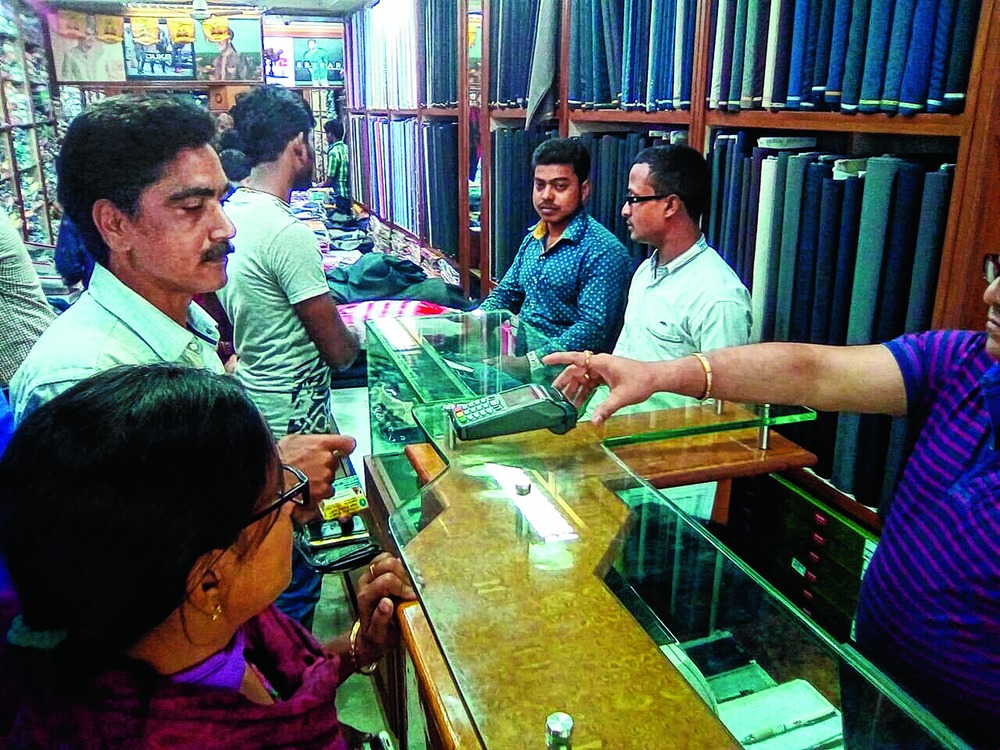

"The shop owner took the card and swiped it on the machine and handed over the PoS machine to me to key in my PIN for authorisation. He advised me not to share my debit card PIN with anyone. Later, he handed over the receipt that certifies that the amount was withdrawn from my bank account," added Rajendra.

Textile merchant Manoj Maradaraj can't help but notice the recent spurt in the use of POS devices.

"Our shop had the device even before the demonetisation. But, earlier, only one or two transactions used to take place in a day. This has now it has shot up to around 40," said Maradaraj.

"If cashless transactions pick up in rural areas, the time will come when plastic money will replace paper currency. We are trying to encourage small traders to go for the PoS mode of transaction," said assistant general manager, SBI, Pramod Pradhan.