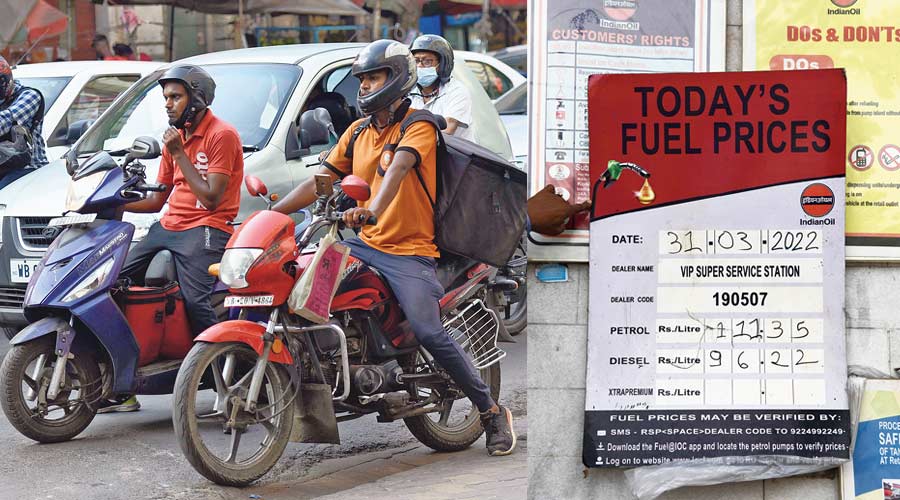

The rising prices of fuel and everything else have made life miserable, not only for the economically weaker sections but also the middle-class.

Retired people, dependent on interest from deposits in banks, are feeling the heat like never before. Many of them had retired with a corpus that they thought would see them through the rest of their lives comfortably.

But the rising cost of living and dipping interest rates have posed stiff challenges for them.

The Telegraph shares the account of one such senior citizen, a 74-year-old man, who worked with the Garden Reach Shipbuilders & Engineers, a PSU.

He retired in 2008, with “a little over Rs 35 lakh”, accrued in “contributory provident fund and gratuity”.

When he retired and made term deposits, the rate of interest (for 10 years) was 10.05 per cent (including an additional 0.5 per cent for senior citizens).

Now, the rate of interest for a similar tenure for senior citizens is 6.2 per cent.

The income has shrunk and the cost of living has ballooned for millions like this septuagenarian, who requested anonymity for the sake of his “dignity”.

He lives on a monthly interest income of “around Rs 30,000”. He also gets a monthly pension of “around Rs 1,700”.

He lives with his wife but has to effectively sustain a family of four. His elder daughter, a homemaker, lost her husband a year ago. She has a son who is in Class XII of a school affiliated to the Council for the Indian School Certificate Examinations.

“Medicines, food, electricity bills and the education cost of my grandson account for my entire monthly income,” the man told The Telegraph.

The combined monthly medicine bills of the elderly couple run up to “Rs 6,000”.

His grandson’s education expenses run up to “Rs 7,000” every month.

“The amount I used to spend on a week's bazaar a few years ago is now spent only on a week’s groceries,” said the man.

The family has been trying to curtail costs as much as possible.

Chicken, earlier a staple on the dining table, is now cooked once a week.

Costly fish — prawns, hilsa and bhetki — have almost gone off the menu. The ubiquitous katapona is there, almost every day, but the pieces have reduced from 50g to 25g.

There are two air-conditioners in the flat — near Behala Parnasree in southwest Kolkata — of the senior citizen. Even in searing heat, the family members try to be mindful of using the AC. Her daughter lives in a nearby apartment but spends a lot of time at her father’s place.

“We try to huddle in one room if we switch the AC on,” he said.

His elder daughter said other than comfort, social interactions had also taken a back seat.

“Unless absolutely avoidable, we skip social gatherings, where you have to go with a gift or go in a taxi. Several of our relatives, and people everywhere, are also doing the same,” she said.