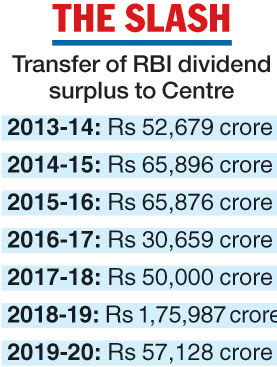

The Reserve Bank of India (RBI) has decided to transfer Rs 57,128 crore as dividend to the Centre for 2019-20, which is substantially lower than the record payout of Rs 1.76 lakh crore last year.

The sharp moderation in the sum compounds the problems for the Centre at a time when it is grappling with a parlous treasury resulting from poor tax collections after the outbreak of Covid-19.

The country’s fiscal deficit has already widened to Rs 6.62 lakh crore, or 83.2 per cent of the budget estimates, in the first quarter of this fiscal.

In the 2020-21 Union budget, finance minister Nirmala Sitharaman had budgeted for a dividend payout of Rs 89,649 crore from the RBI and state-owned banks. The surplus transfer from the central bank had been pegged at Rs 60,000 crore.

The decision to transfer over Rs 57,000 crore was taken at the 584th meeting of the Central Board of the RBI, chaired by governor Shaktikanta Das on Friday.

The dividend payout had snowballed into a huge controversy in 2018 and led to sharp differences between then RBI governor Urjit Patel and the Narendra Modi government over the size of the central bank’s balance sheet.

It eventually led to the resignation of Patel and the appointment of a committee headed by former RBI governor Bimal Jalan to decide on the economic capital framework of the RBI. The panel’s recommendations had been accepted before the massive payout last year.

The RBI earns its profits from trading in currencies and government bonds as well as printing notes and coins. Traditionally, the RBI used to set aside a part of these earnings to meet its operational and contingency fund requirements before transferring the rest to the government in the form of dividend.

Contingent funds

The RBI’s reserves consist of two parts: the first is a contingent reserve buffer (CRB) that the Bimal Jalan committee described as “realised equity”, and the second is a notional fund called the currency and gold revaluation account (CGRA) that represents the unrealised revaluation gains arising from exchange rate movements and the rise in gold prices.

The Jalan committee had recommended that the Centre had no right to dip into the CGRA fund. It also said the RBI could retain between 5.5 and 6.5 per cent of its balance sheet size in the CRB fund and transfer any excess to the Centre as dividend.

The CRB, which the Jalan panel termed a “rainy day” fund, is a specific provision that the RBI maintains to meet unexpected and unforeseen contingencies, including depreciation in the value of securities, risks arising out of monetary or exchange rate policy operations, systemic risks and any other risks.

In 2018-19, the CRB fund stood at 6.8 per cent of the balance sheet corpus. So, the central bank decided to cap the size of this fund at the minimum mandated level of 5.5 per cent and transferred an excess risk provision as a one-time outgo of Rs 52,637 crore to the Centre.

In addition, the RBI transferred a surplus of Rs 123,350 crore from its balance sheet. A part of the payment had been made in the form of an interim dividend of Rs 28,000 crore on March 28, 2019 -- with the rest being transferred in August that year. The RBI has a financial year that ends on June 30.

The details of the latest RBI transfer will be known when the central bank comes out with its annual report for 2019-20 sometime later this month.

Ananth Narayan, senior India analyst at the Observatory Group, said in a note in June that in the year ending June 2019, the RBI had kept its realised equity at the minimum level of 5.5 per cent and transferred the rest to the government.

“Since then, the RBI’s balance sheet has expanded by 29 per cent. To maintain realised equity at 5.5 per cent of the balance sheet, it would have to retain about Rs 65,000 crore of earnings when it closes its books in June 2020.… The overall balance sheet has expanded 29 per cent over the past year, from Rs 41 trillion to Rs 53 trillion (around 26 per cent of the GDP). This is on the back of an increase in holdings of foreign currency assets, a revaluation gain in the value of foreign currency assets, an increase in holdings of government bonds, and an increase in rupee advances to Indian banks,” Narayan said in the note.