Mumbai, Nov. 19: Anyone interested in buying a minimum 5 per cent stake in a private bank has to take permission from the RBI.

Along with notifying this mandatory norm, the RBI has put forward stringent due diligence rules for major shareholders. It notified the continuous monitoring of the "fit and proper" status of the shareholders of a private bank.

Shareholders, who already have RBI approval for a major holding in a bank, will now have to report to the lender for a review of their "fit and proper" status. The lender will have to immediately report to the RBI if a shareholder is deemed unfit.

The apex bank said it would determine whether an interested party was "fit and proper" while considering proposals for stake acquisition.

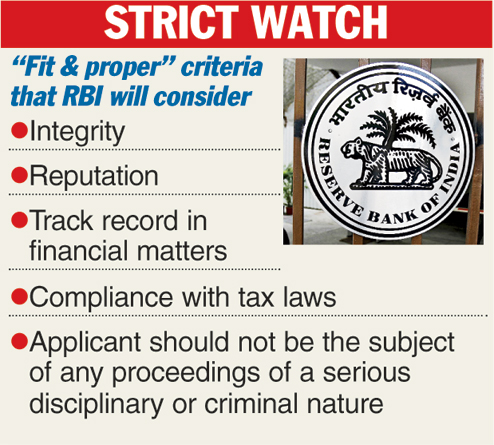

The RBI will look into the applicant's integrity, reputation, track record in financial matters and compliance with tax laws. It will also assess whether the applicant has been the subject of any proceedings of a serious disciplinary or criminal nature, or has been notified of any such impending proceedings.

"The process of due diligence, may also involve a reference to the relevant regulator, revenue authorities, investigation agencies, credit rating agencies, as considered appropriate," the central bank said.

"Considering all the facts, the Reserve Bank may accord or deny permission or accord permission for acquisition of a lower quantum than that has been applied for," it added.

However, existing major shareholders will not be required to obtain prior approval for incremental acquisition of shares or voting rights if the proposed aggregate holding is up to 10 per cent.

The shareholder will have to furnish the details of the source of funds for such acquisition and obtain "no objection" from the bank.