New Delhi: ONGC Ltd, the state-owned oil explorer, has got government approval to sell its stakes in Indian Oil Corporation and GAIL India and is weighing its options to fund its acquisition of HPCL.

New Delhi: ONGC Ltd, the state-owned oil explorer, has got government approval to sell its stakes in Indian Oil Corporation and GAIL India and is weighing its options to fund its acquisition of HPCL.

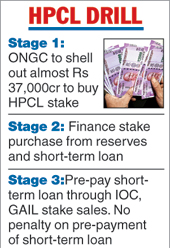

ONGC holds a 13.77 per cent stake in the nation's biggest refiner Indian Oil Corp (IOC), which at Tuesday's trading price is worth over Rs 26,200 crore. It also holds a 4.86 per cent stake in gas utility GAIL India Ltd, which is worth over Rs 3,847 crore.

For the moment, ONGC is funding the Rs 36,915-crore acquisition of the government's 51.11 per cent stake in oil refining and marketing firm Hindustan Petroleum Corp Ltd (HPCL) through its cash kitty of Rs 12,000-crore cash and short-term borrowing.

Sources said ONGC was a zero-debt company and wants to retain that status. The short-term loan it is taking has a provision to pre-pay without any penalty. It plans to pre-pay the one-year tenure loan it is taking for HPCL by selling the IOC and GAIL shares in the future, they said.

ONGC chairman and managing director Shashi Shanker had earlier stated that the company's board had approved the raising of the borrowing limit to Rs 35,000 crore from Rs 25,000 crore. This will be the company's first ever debt.

"We will use our (Rs 12,000-13,000 crore) cash first and then the liquid assets and debt will be last," Shanker had said. "This order can change, because we won't sell the liquid assets in distress. Also, we have offers for over Rs 50,000-crore debt at very competitive rates."

This would be ONGC's biggest acquisition and second buyout this fiscal after its Rs 7,738-crore acquisition of a 80 per cent stake in Gujarat State Petroleum Corp's KG (Krishna-Godavari) basin gas block.

Selloff target

The HPCL stake sale will help the government to cross its selloff target for the first time and help it to stick to its fiscal deficit target of 3.2 per cent of GDP.

The government had set a target of Rs 72,500 crore from disinvestment proceeds this fiscal. Before the ONGC-HPCL deal, it had collected Rs 54,337.60 crore.

Shanker had said the company paid less than the acquisition price recommended by the its valuation adviser, EY. He, however, refused to share details.