Shares of the now grounded Jet Airways on Tuesday tanked nearly 11 per cent on reports the Hinduja group and Etihad Airways may not proceed with their plan to revive the airline.

The development comes at a time two operational creditors moved the National Company Law Tribunal (NCLT) seeking bankruptcy proceedings against the airline.

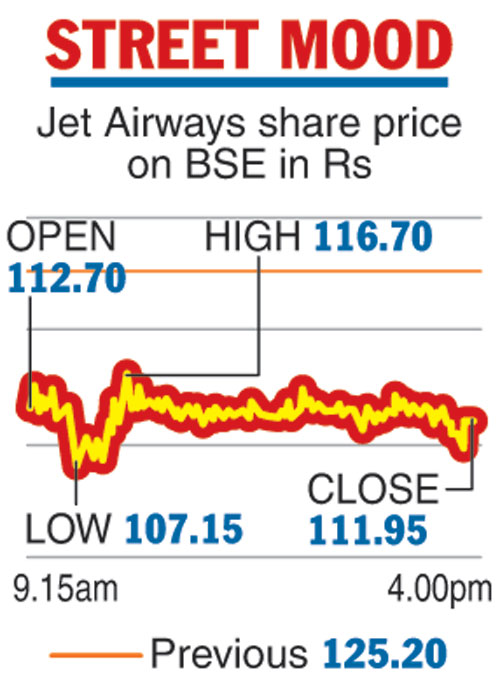

The Jet stock tumbled 10.58 per cent on the BSE to close at Rs 111.95 after plunging 14.41 per cent during intra-day trades to Rs 107.15 — its 52-week low.

Similarly, Jet dropped 10.25 per cent to close at Rs 112 on the NSE. In terms of volumes, 18.10 lakh shares were traded on the BSE and over one crore shares changed hands on the NSE.

Following the drop in its share price, the company's market valuation fell Rs 150.28 crore to Rs 1,271.72 crore on the BSE.

The Telegraph

The drop came on media reports the Hinduja group and Etihad Airways may not proceed with plans to acquire the airline. Jet Airways owes more than Rs 8,000 crore to a consortium led by the SBI.

The lenders had appointed SBI Capital Markets to scout for an investor.

Bids were invited in April for up to a 75 per cent stake in the carrier, with Etihad, two private equity players and India’s National Investment and Infrastructure Fund showing interest. However, the exercise did not make any significant progress.

Tribunal hearing

Meanwhile, two operational creditors — Shaman Wheels and Gaggar Enterprises — have moved the NCLT seeking bankruptcy proceedings against the airline.

The tribunal on Monday, issued notices to Jet and banks and posted the matter for further hearing on June 13 when it will decide to admit or reject the bankruptcy pleas.

Jet Airways had recently announced that it is not in a position to approve the audited financial results for 2018-19.