The Saudi overseas venture is a joint venture set up by IL&FS Engineering and SBG Projects to pursue projects in Saudi Arabia.

The Saudi Bin Laden Group, which employs some 1 lakh people, has revenues upwards of $30 billion annually.

A sum of Rs 374 crore, net of payments to be made to sub-contractors, as well as another Rs 355 crore has remained pending for the engineering firm and stuck in litigation for a long time. The management, however, refused to acknowledge in its audit reports that were examined by the department of corporate affairs.

Analysts say the bulk of IL&FS’s revenue was in the form of receivables, about half of which was locked up in litigation and arbitration. The government also pointed out on Monday that “the high debt stress was clearly visible in the company and its main subsidiaries for the last so many years, but was camouflaged by misrepresentation of facts”.

Most of the projects had run aground and was the subject of litigation because they were started and money sunk into them without land being acquired or clearances received. The government on Monday approached the courts to appoint a new board at ILFS, the holding company for the group.

An official statement had said, “The decision to supersede the existing board was taken after careful consideration of a report which clearly brought out serious corporate related deficiencies in the IL&FS holding company and its subsidiaries.”

The government had also said: “There have also been serious complaints on some of the companies for which an SFIO investigation has been ordered into the affairs of IL&FS and its subsidiaries.”

Officials said an SFIO team, which has seized a host of documents and computer data from the IL&FS offices around the country, would be analysing them to check what went wrong and whether there were any guilty secrets within the group.

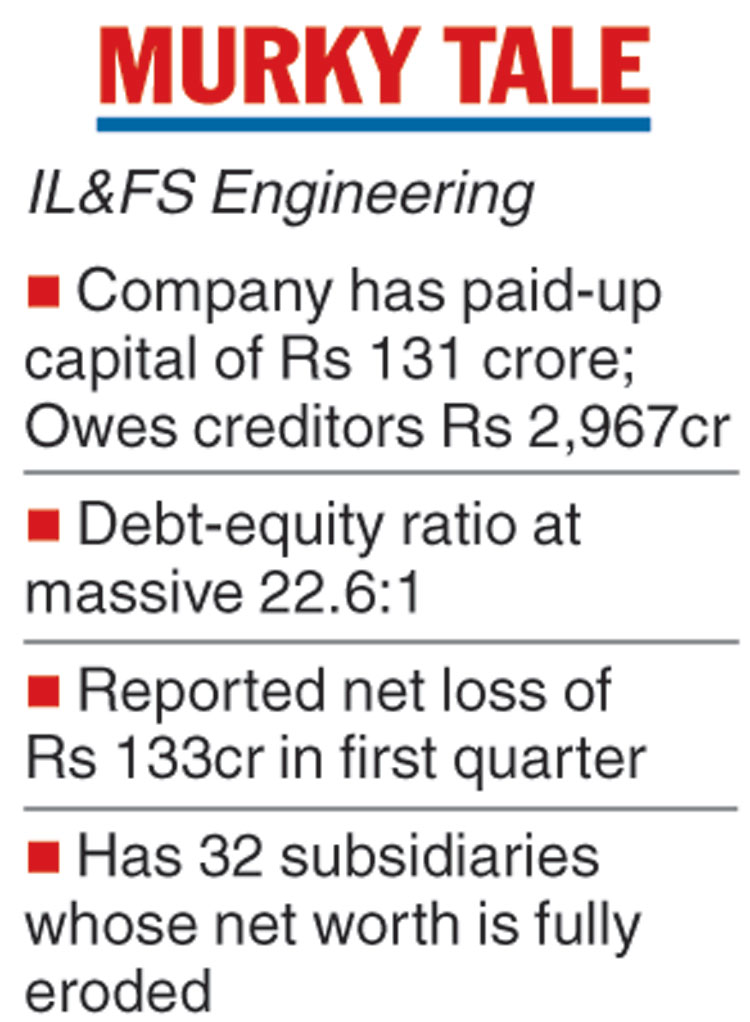

Troubled shadow bank lender IL&FS’s even more troubled arm — IL&FS Engineering — owes creditors Rs 2,967.59 crore despite having a paid-up capital of just Rs 131 crore, which means it has an unbelievably unviable debt-to-equity ratio of 22.6:1, which means it has borrowed Rs 22 for every rupee it has of its own funds.

IL&FS Engineering, which ran up a net loss of Rs 133 crore for the quarter ended June 2018, has some Rs 343 crore worth of inter-corporate deposits which it has not been able to get back as yet. The bulk of it came from Satyam Computer, the firm whose board was similarly suspended in 2009 and replaced by a court for gross mismanagement.

The firm also has a web of some 32 subsidiaries and joint ventures with names ranging from Ekdanta Greenfields to Saptarswara Agro-Farms to Hill Counties Properties Ltd and one single foreign subsidiary — Maytas Infra Saudi Arabia — whose net worth is fully eroded according to reports.

Curiously, its biggest single stand-alone shareholder is an arm of Saudi Bin Laden Group, which was started by the infamous Osama Bin Laden’s father.

While IL&FS, the founder of IL&FS Engineering, holds 20.96 per cent equity and IL&FS Financial Services has another 21.29 per cent, SBG Projects Investments Pvt Ltd has some 27.87 per cent stake.

It must be stated that Saudi Bin Laden Group has a legitimate corporate profile and isn’t tainted by the actions of the mastermind of the 9/11 attacks in the US.

Without naming the overseas subsidiary, an independent auditors’ review report of quarterly financial results of IL&FS Engineering by BSR Associates LLP and M Bhaskara Rao & Co. says “the company has an investment of Rs 3577 lakhs made in an overseas subsidiary. Based on latest available unaudited financial statements of the aforesaid subsidiary as at March 31, 2018, the net worth of the subsidiary is fully eroded and the company may have potential obligation to share further liabilities of the said subsidiary”.

The Telegraph