Automotive and industrial battery maker Exide Industries has seen an 81 per cent growth in standalone net profit for the quarter ended June 30, aided by a growth in topline despite high input cost inflation.

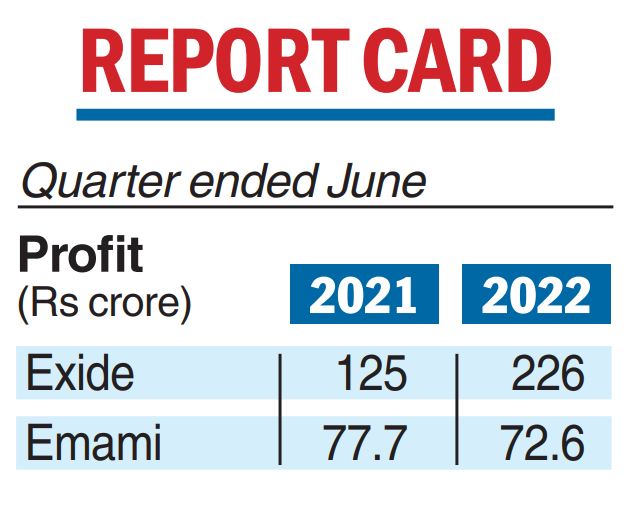

Standalone net profit during the quarter was Rs 226 crore compared with Rs 125 crore in the year-ago period. Revenue from operations was Rs 3,899 crore, up 57 per cent from Rs 2,486 crore a year ago.

The battery maker said on Friday that its total fixed expenses (employee costs and other expenses) were at 18 per cent of sales during Q1FY23 compared with 21 per cent during Q1FY22 and the company’s efforts towards cost optimisation have helped lower fixed costs.Exide said that through its wholly owned subsidiary, Exide Energy Solutions, the company has procured 80 acres of land in Karnataka to set up its planned lithium-ion cell manufacturing project.

“New products are garnering excellent customer response and fixed costs are lower compared with the previous year.

However, high commodity prices leading to an escalation in raw material costs along with escalation in fuel and freight costs have continued to be a drag in this quarter,” said Subir Chakraborty, MD and CEO of Exide Industries.

Emami PAT drops

Emami Ltd has posted a 6.5per cent drop in profit after tax (PAT) in the June quarter on a consolidated basis despite a 16.8 per cent rise in total income as cost push dented profitability.

The FMCG company reported a PAT of Rs 72.69 crore in Q1FY23 compared with Rs77.79 crore in the same period of the last fiscal. Total income rose to Rs 784.62 crore compared with Rs 671.67 crore inQ1FY22.

The company blamed the inflationary headwinds which led to softening of demand, both in the rural and urban markets leading to margin compression.

Emami, which recently acquired Dermicool talc, said domestic net sales grew by 8per cent.