Sebi on Thursday eased the compliance rules pertaining to 25 per cent minimum public shareholding for listed entities in the wake of the coronavirus pandemic.

The decision has been taken after receiving requests from listed entities and industry bodies as well as considering the prevailing business and market conditions.

In a circular, the Securities and Exchange Board of India (Sebi) said it has decided to grant relaxation from the applicability of minimum public shareholding (MPS) requirement.

The rules have been relaxed for listed entities for whom the deadline to comply with MPS requirements falls between the period from March 1, 2020 to August 31, 2020. Under Sebi norms, listed entities are required to have at least 25 per cent public shareholding.

Stock exchanges have been asked to not take any penal action against such entities in case of non-compliance during the said period.

Penal actions, if any, initiated by exchanges from March 1, 2020 till date for non-compliance of MPS requirements by such listed entities may be withdrawn, the regulator added.

As per the norms, exchanges can impose a fine of up to Rs 10,000 on companies for each day of non-compliance with MPS requirements.

Besides, exchanges can intimate depositories to freeze the entire shareholding of the promoter and promoter group. This circular shall come into force with immediate effect, the regulator said.

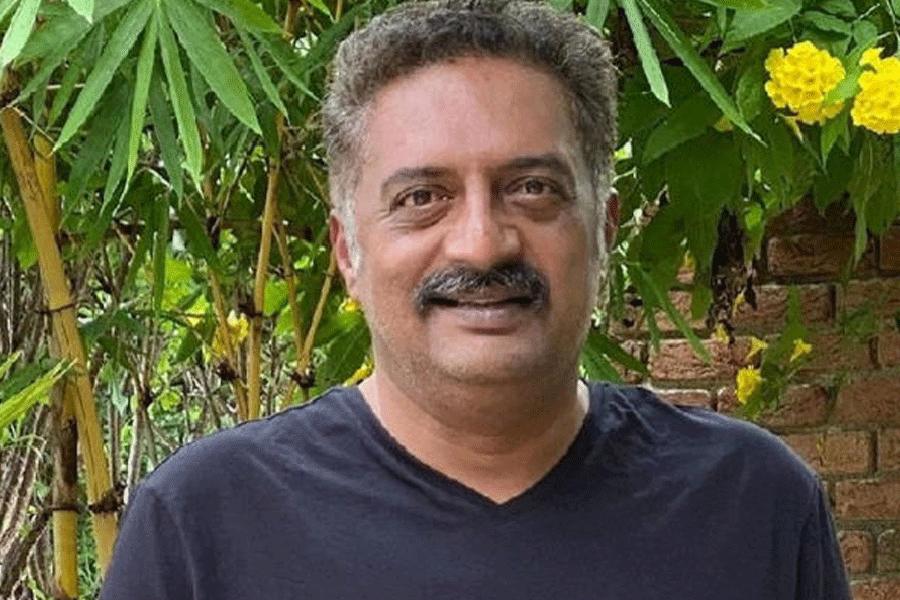

On Wednesday, Ajay Tyagi, chairman, Sebi held a conference call with Ficci. The meeting was part of a series of interactions that the Sebi chief had with various stakeholders.

The Sebi chief had earlier interacted with the representatives of the CII.

At the meetings, several issues concerning the industry in the light of the lockdown were discussed, including those relating to the raising of capital, corporate debt market and disclosures.

Last month, Sebi gave time till September-end to certain companies for conducting their annual general meetings.