Mumbai, Jan. 19: Axis Bank, the country's third-largest private lender, today posted a disappointing set of numbers for the third quarter ended December as its net profit plunged 73 per cent following a sharp rise in provisions.

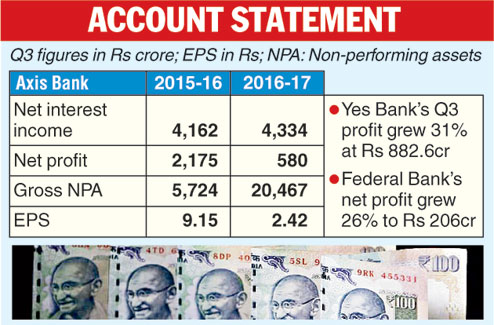

The bank's net profit during the quarter fell to Rs 579.57 crore from Rs 2,175.30 crore in the year-ago period. This came after its provisions jumped to Rs 3,795.80 crore from Rs 712.59 crore a year ago.

During the quarter, the bank's asset quality deteriorated further compared with the previous year. In absolute terms, gross non performing assets (NPAs) jumped nearly four times at Rs 20,466.82 crore against Rs 5,724.05 crore last year. However, on a sequential basis, it showed a small increase over Rs 16,378.65 crore in the preceding three months.

The percentage of gross NPA stood at 5.22 per cent (1.67 per cent) and 4.17 per cent in the second quarter.

Axis Bank's chief financial officer Jairam Sridharan said most of the slippages, or fresh NPAs, came from the watch list. During the third quarter, slippages stood at Rs 4,560 crore, lower than Rs 8,772 crore in the preceding three months, but higher than Rs 2,082 crore last year.

The bank's core net interest income grew 4 per cent to Rs 4,334 crore from Rs 4,162 crore last year. However, demonetisation had its impact on property and agriculture-related disbursements.

Yes Bank show

Private lender Yes Bank has reported better-than-expected numbers with its net profit for the third quarter at Rs 882.6 crore against Rs 675.6 crore in the year-ago period.

A heavy influx of deposits into the low-cost current and saving account deposits helped increase its net interest margin to 3.5 per cent during the quarter.

The lender's core net interest income rose 30.3 per cent to Rs 1,507 crore, while the non-interest income was up 33.8 per cent at Rs 998 crore.

CASA (current and savings accounts) ratio stood at 33.3 per cent compared with 26.6 per cent a year ago. Savings account and current account deposits grew 64.3 per cent and 61.5 per cent, respectively.

Federal Bank

Private sector lender Federal Bank's third-quarter net profit rose 26.4 per cent to Rs 205.65 crore from Rs 162.72 crore a year ago, as higher interest income and fewer slippages helped reap gains.

"Total income has increased to Rs 2,544.75 crore for the quarter from Rs 2,086.07 crore a year ago," it said.

Its interest income rose to Rs 2,281.42 crore, up 19.9 per cent from Rs 1,903.25 crore a year ago.