After sanctions hobbled production at its assembly plant in Kaliningrad, the Russian automaker Avtotor announced a lottery for free 10-acre plots of land — and the chance to buy seed potatoes — so employees could grow their own food in the western-most fringe of the Russian empire during “the difficult economic situation”.

In Moscow, shoppers complained that a kilogram of bananas had shot up to 100 roubles from 60, while in Irkutsk, an industrial city in Siberia, the price of tampons at a store doubled to $7.

Banks have shortened receipts in response to a paper shortage. Clothing manufacturers said they were running out of buttons.

“The economic prospects for Russia are especially gloomy,” the Bank of Finland said in an analysis this month. “By initiating a brutal war against Ukraine, Russia has chosen to become much poorer and less influential in economic terms.”

Even the Central Bank of Russia has predicted a staggering inflation rate between 18 and 23 per cent this year, and a falloff in total output of as much as 10 per cent.

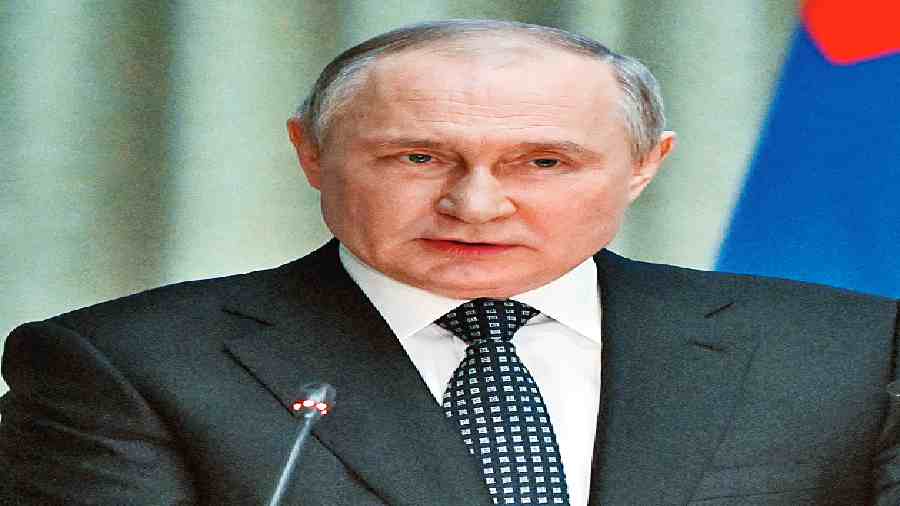

It is not easy to figure out the impact of the war and sanctions on the Russian economy at a time when even using the words “war” and “invasion” are illegal. President Vladimir V. Putin has insisted that the economy is weathering the measures imposed by the US, Europe and others.

Financial maneuvers taken by Moscow helped blunt the economic damage initially. At the start of the conflict, the central bank doubled interest rates to 19 per cent to stabilise the currency, and recently was able to lower rates to 14 per cent. The rouble is trading at its highest level in more than two years.

And even though Russia has had to sell oil at a discount, dizzying increases in global prices are causing tax revenues from oil to surge past $180 billion this year despite production cuts, according to Rystad Energy. Natural gas deliveries will add another $80 billion to Moscow’s treasury.

In any case, Putin has shown few signs that pressure from abroad will push him to scale back military strikes against Ukraine.

Still, Avtotor’s vegetable patch lottery and what it says about the vulnerabilities facing the Russian people, along with shortages and price increases, are signs of the economic distress that is gripping some Russian businesses and workers since the war started nearly three months ago.

Analysts say that the rift with many of the world’s largest trading partners and technological powerhouses will inflict deep and lasting damage on the Russian economy.

“The really hard times for the Russian economy are still in front of us,” said Laura Solanko, a senior adviser at the Bank of Finland Institute for Emerging Economies.

The stock of supplies and spare parts that are keeping businesses humming will run out in a few months, Solanko said. At the same time, a lack of sophisticated technology and investment from abroad will hamper Russia’s productive capacity going forward.

The Russian Central Bank has already acknowledged that consumer demand and lending are on a downhill slide, and that “businesses are experiencing considerable difficulties in production and logistics”.

Ivan Khokhlov, who co-founded 12Storeez, a clothing brand that evolved from a showroom in his apartment in Yekaterinburg to a major company with 1,000 employees and 46 stores, is contending with the problem firsthand.

“With every new wave of sanctions, it becomes harder to produce our product on time,” Khokhlov said. The company’s bank account in Europe was still blocked because of sanctions shortly after the invasion, while logistical disruptions had forced him to raise prices.

“We face delays, disruptions and price increases,” he said. “As logistics with Europe gets destroyed, we rely more on China, which has its own difficulties too.”

Hundreds of foreign firms have already curtailed their business in or withdrawn altogether from Russia, according to an accounting kept by the Yale School of Management. And the exodus of companies continued this week with McDonald’s. The company said that after three decades, it planned to sell its business, which includes 850 restaurants and franchises and employs 62,000 people in Russia.

“I passed the very first McDonald’s that opened in Russia in the ’90s,” Artem Komolyatov, a 31-year-old tech worker in Moscow, said recently. “Now it’s completely empty. Lonely. The sign still hangs. But inside it’s all blocked off. It’s completely dead.”

Nearby two police officers in bullet-proof vests and automatic rifles stood guard, he said, ready to head off any protesters.

In Leningradsky railway station, at one of the few franchises that remained open on Monday, customers lined up for more than an hour for a last taste of McDonald’s hamburgers and fries.

The French automaker Renault also announced a deal with the Russian government to leave the country on Monday, although it includes an option to repurchase its stake within six years. And the Finnish paper company, Stora Enso, said it was divesting itself of three corrugated packaging plants in Russia.

More profound damage to the structure of the Russian economy is likely to mount in the coming years even in the moneymaking energy sector.

Europe’s vow to eventually turn its back on Russian oil and gas will compel Moscow to search further afield for customers, particularly in China and India. But the pivot to Asia, said Daria Melnik, a senior analyst at Rystad Energy, “will take time and massive infrastructure investments that in the medium term will see Russia’s production and revenues drop precipitously”.

Without sufficient storage capacity, Russia may have to cut its overall oil and gas production. Wells aren’t like faucets, though, easily turned on and off. Cap one, and most likely it can never be used again.

“Some Russian spare capacity will be destroyed,” Melnik said of the country’s oil flow.

Anton Siluanov, the Russian finance minister, said that sanctions could cause as much as a 17 per cent drop in oil output this year.

Bigger slides are apparent in other sectors. Passenger car production was down 72 per cent in March compared with the previous year.

In the industrial sector, which includes chemicals, oil, gas and manufacturing, the four-week average for the volume of imports is down 88 per cent compared with early February, before the invasion, according to FourKites, which tracks supply chains.

The volume of consumer-related imports is down 76 per cent, making it difficult for Russians to buy tampons and cellphones, and for hospitals to get replacement parts and supplies for dialysis machines and ventilators.

In a survey of health care professionals in April, 60 per cent of respondents said they had experienced shortages already. Among imported products, the items missing most included disposable gloves, catheters and suture materials.

For consumers, price jumps on basic goods have been so noticeable that a Twitter account has sprung up mocking social media posts in which Russians lament price increases on everything from Palmolive shampoo to nectarines. It is called But What Happened? and has nearly 44,000 followers.

A 26-year-old Moscow resident, who asked that her name not be used because of fear of reprisals, said the cost of imported fruit, like the bananas she puts in her oatmeal every morning, had skyrocketed.

“It’s the product I buy every single time I go to the store, so I noticed immediately,” she said. Her total grocery bill has shot up by about one third, she said. In Irkutsk, the price of a box of tampons doubled from $3.50 within weeks of the war’s start, said a 23-year-old designer who earns $450 a month and asked that she not be named.

New York Times News Service