A sizeable portion of the private hospital bills of insured Covid-19 patients who have not taken a virus-specific policy is now made up of “non-medical” expenses like the cost of PPE kits, facemasks, gloves and hand-sanitisers that are not covered by the insurance agencies.

The patients, therefore, have to pay out of their own pockets for these articles, whether used by themselves or by the doctors and hospital staff involved in their treatment.

Public health experts and hospital officials said these should be treated as medical expenses for the duration of the Covid-19 crisis, but insurance company representatives showed little enthusiasm for the idea.

After an elderly Covid-19 patient died recently at a private hospital in Calcutta, the insurance agency approved payment for only Rs 107,032 against a bill for Rs 203,846, leaving the patient’s son to shell out Rs 96,814.

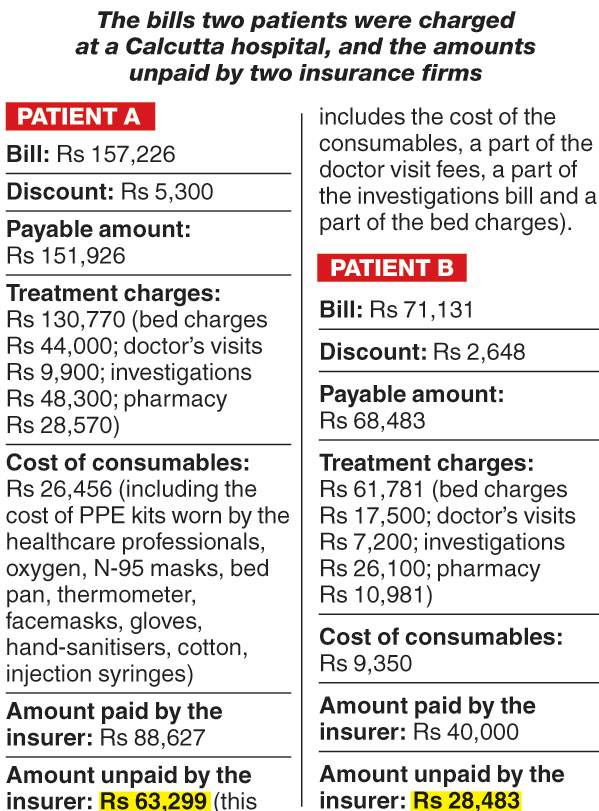

At another hospital, a woman who was discharged on Wednesday was billed Rs 151,926 but the insurer paid only Rs 88,627.

The non-medical expenses that the insurer refused to cover included the cost not just of the PPE kits, gloves, facemasks and hand-sanitisers but also of the injection syringes and cotton used.

The insurer contended it was merely following the guidelines of the Insurance Regulatory and Development Authority (IRDA). Many healthcare institutes have, therefore, welcomed Saturday’s advisory by Bengal’s regulator for private hospitals that allows them to demand an advance deposit of up to Rs 50,000 or 20 per cent of the estimated treatment cost, whichever is lower. The hospitals say that these deposits are a protection for them, because many patients decline to pay the sums that the insurers refuse to cover.

Some insurance companies said they were paying for PPE kits in accordance with the ceiling fixed by the state government, which is Rs 1,000 per patient per day, but others said they were not covering this at all.

This has led to thousands of people in Calcutta buying a new Corona Kavach insurance policy, announced by the IRDA and sold by all health insurers, which promises to cover most of these non-medical expenses. Launched in July, the policy also pays a fixed amount for ambulances.

“In one month, between July 10 and August 10, we have sold 16,000 Corona Kavach policies. Barely a couple of claims from such policies have been submitted till date,” said Saurav Kariwala, assistant manager (media), of the National Insurance Company Ltd, Calcutta.

He said another general health insurance policy launched in April had had barely 200 buyers till now.

Kavach question

Most of those buying the Corona Kavach policy have, however, had another health insurance policy for years.

“Instead of selling a new policy, the insurance companies should think of the thousands of their customers who have already been paying premiums for many years. The relatives of many Covid-19 patients are calling us every day to find out why PPE and other protective equipment have not been included in the insurance approval lists,” said Sudipta Mitra, chief executive of Peerless Hospital.

“We have spoken to the insurance companies many times but they only tell us these items cannot be included in the admissible list.”

Pradip Tondon, CEO of Belle Vue Clinic, said: “We have urged the insurance companies to be more flexible in these times and not to go by the rules so strictly. The unpaid amount is often causing disputes between the hospitals and patients.”

In normal times, many insured patients undergo surgeries and procedures under specific insurance packages agreed between the hospital and the insurer, which leaves little room for dispute.

An official at a private hospital said 40 per cent of insurance patients are admitted under such packages.

But in the case of medical treatment whose course and requirements are unpredictable, and which therefore do not lend themselves to pre-specified packages, the insurers often refuse to pay a substantial portion of the bill. A large percentage of the items whose cost these companies refused to reimburse tend to be consumable items.

Covid-19 falls under the head of diseases whose treatment requirements are indefinite. “So, there is no definite package and hence the inadmissible amount (the sum the insurer refuses to pay) is high,” an official with an insurance company said.

While private hospitals blamed the patients’ woes over their bills on the insurers’ reluctance to cover the non-medical expenses, insurance officials put the blame back on the hospitals.

An insurance official said the problem was that if consumable items were included in the approved list, some hospitals would indulge in “unethical business” — because it is impossible to monitor, for instance, how many gloves or facemasks were actually used.

An official with another insurance company said the government should increase its scrutiny of private hospitals’ bills. “When private hospitals charge exorbitantly, we scrutinise the bill and if some amounts are not justified, we refuse to reimburse them,” said Dipayan Saha, medical officer, HDFC ERGO, a private insurance company.

“But that amount then becomes the burden of a patient. We are bound by the rules and can’t do anything. The West Bengal Clinical Establishment Regulatory Commission should find a mechanism to randomly scrutinise private hospitals’ bills.”

Saha said his company was reimbursing the cost of PPE kits and doctors’ visits in accordance with the state government’s rates.

Public health experts said that both the insurance companies and private hospitals needed to be more humane. “The insurance companies and hospitals should work towards making life less miserable for the Covid-19 patients, many of whom have lost their incomes. We have to be more humane in these difficult times and not think of protocols and profits,” said Dr Abhijit Chowdhury, a public health expert.