Toyota Kirloskar Motor (TKM) is lobbying for a merit-based taxation on technologies such as hybrids. Hybrids are said to have “the lowest carbon footprint from a well-to-wheel perspective, according to a study by the Bengaluru-based Indian Institute of Science (IISc).

The company is hoping for a GST reduction on hybrids when the GST Council meets after the elections.

The hybrids are taxed at a rate of 28 per cent GST, which, along with cess, takes the taxation to 40 per cent in certain vehicles. However, according to reports, despite recommendations by transport minister Nitin Gadkari for a 12 per cent GST for hybrids, the council is not keen on a reduction.

Toyota, which has introduced hybrids in mass market segments with vehicles such as the Hyryder, feels that the government policies should be aligned towards its goals of making the country net zero by 2050.

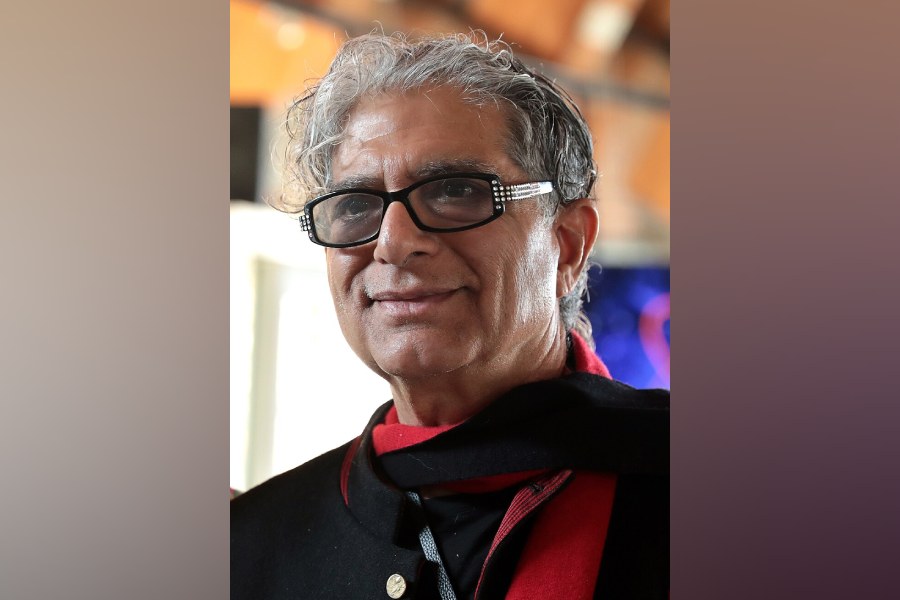

“As we seek energy self-reliance by 2047 and very ambitious targets on carbon reduction, the policies should begin to align themselves with technologies. To speed up the realisation of national goals on fossil fuels, decarbonisation, job creation, and linkages will have to happen and those policy alignments should take place. And the market should be left to decide how best various technologies help meet those objectives transparently and neutrally,” said Vikram Gulati, country head and executive vice-president, TKM.