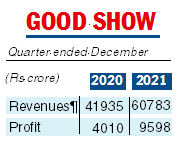

Tata Steel posted a 139 per cent jump in net profit in the third quarter to Rs 9,598 crore on a consolidated basis compared with the same period last fiscal.

Revenue went up 44.9 per cent to Rs 60,783 crore as the steel maker continues to enjoy strong pricing amid tight demand across geographies including Europe.

The company posted EBIDTA growth of 64 per cent during the quarter at Rs 15,853 crore, enabling it to reduce debt by another Rs 5,953 crore during the three months ending December 31, 2021.

With strong free cash flow, it managed to reduce debt by Rs 17,376 crore in the nine-month period.

At the end of the nine months, Tata Steel’s gross debt stood at Rs 72,603 crore while net debt was down to Rs 62,869 crore.

The company also spent Rs 2,790 crore on capex to build the 5 million tonne (mt) plant at Kalinganagar, Odisha during the last three months. Over the nine months, it spent Rs 6,416 crore.

While Tata Steel’s India business continued to shine with Rs 7,787 crore of profit after tax, Europe also delivered strong results. It posted EBIDTA of Rs 2,942 crore compared with a loss of Rs 724 crore.

T.V. Narendran, CEO and MD of Tata Steel said: “India steel demand has begun to improve on the back of continued economic recovery as the third wave of Covid begins to ebb. Our steel deliveries in India expanded by 4 per cent in the first nine months of the financial year along with an improvement in product mix.”

Koushik Chatterjee, ED and CFO added: “Tata Steel continues to remain focused on its enterprise strategy to deleverage its balance sheet while it pursues its growth priorities. As a result of the strong financial performance, our net debt/EBIDTA has come down further.”

However, the European as well as Indian profitability were muted compared with the second quarter of this ongoing fiscal because of the higher cost of coking coal, a crucial raw material for blast furnace based steel makers.