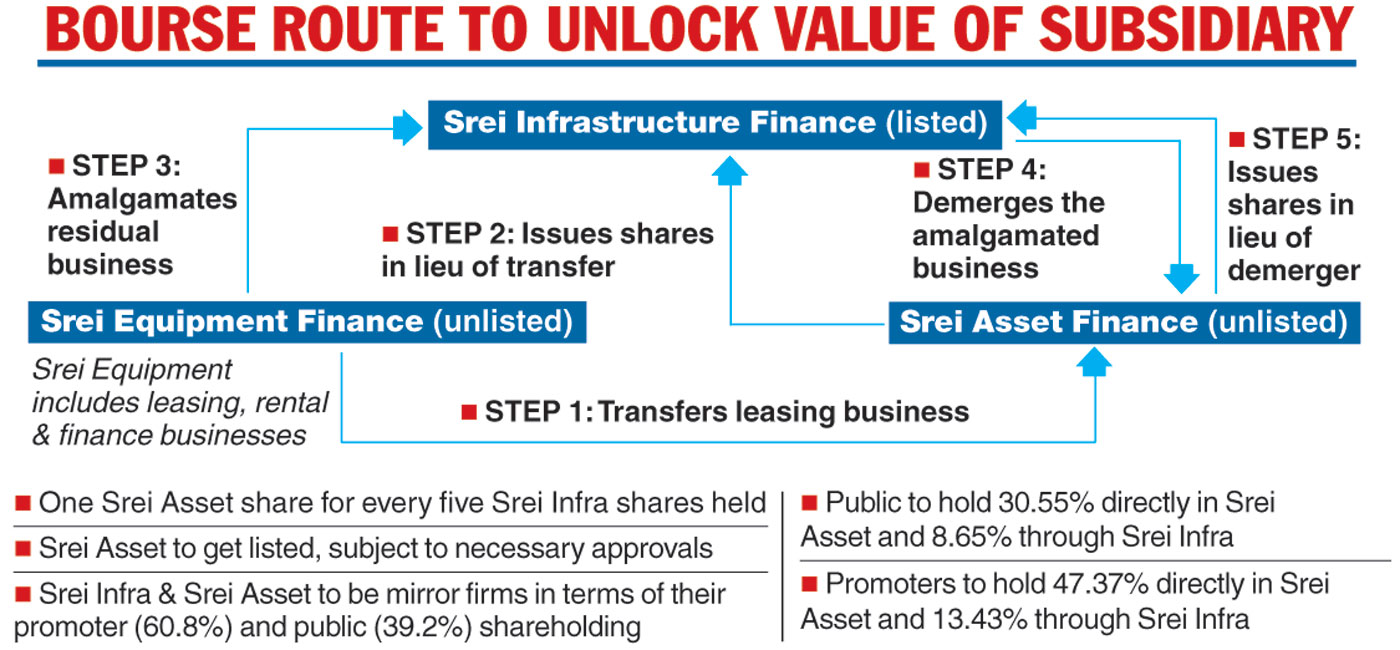

The Kanorias of infrastructure company Srei have proposed a scheme of arrangement to list the crown jewel of their business empire, Srei Equipment Finance, on the bourses after abandoning plans of an initial public offer.

The new entity will be named Srei Asset Finance Pvt Ltd on the stock exchanges and it will be a mirror image of Srei Infrastructure Finance Ltd, the current listed entity, by way of shareholding pattern.

Every Srei Infra shareholder will get one share of Srei Asset for every five shares held in the company as on the appointed date. The scheme will take 6-12 months to conclude as it will require the approval of the RBI, the National Company Law Tribunal, Sebi, the shareholders and creditors.

“The decision will unlock value for Srei Infra shareholders as the growing Srei Equipment Finance will be separately listed on the bourses. It will also give opportunity to investors to choose between two different sets of businesses, infrastructure finance and equipment finance,” Hemant Kanoria, chairman and managing director of Srei Infra, said on Monday after unveiling the scheme.

Srei Infra had approached Sebi to take Srei Equipment, the wholly owned subsidiary, for IPO in August 2017 and subsequently received a nod to do so. However, the Kanorias shelved the IPO plan, which was estimated to fetch Rs 1,800-2,000 crore, citing poor market conditions.

The management said Rs 500 crore capital would further be injected in the equipment finance business as and when required.

Devendra Kumar Vyas, the chief executive officer of Srei Equipment, said talks were on with potential investors to raise capital. “This is a simultaneous process along with the scheme. The money may be raised before the listing in one or multiple tranches,” Vyas said.

The scheme

Srei came up with the scheme with three primary objectives in mind. It wanted the fledgling equipment finance business, which has assets under management of Rs 34,001 crore compared with the parent’s Rs 18,889 crore, to get listed.

Second, it wanted Srei Infra to hold some stake directly in the new company, enabling the holding company to monetise the share when needed. This is why the leasing business, which is about Rs 4,000 crore of Srei Equipment, is first transferred to the asset company. As a result, Srei Infra will directly hold about 22 per cent in the new listed company.

Third, it wanted to carry out the above two objectives in a tax efficient manner.

There are many investors who want a pie of the equipment finance business which is easier to understand. At present, they cannot directly invest in the business without putting money through the holding company, which is into infrastructure finance.

Moreover, the management does not expect infrastructure finance to grow significantly in the next few quarters and does not want to add fresh exposure ahead of the general election. “We do not know what the priorities of the new government will be and how it plans to execute infra projects,” a Srei official said.

Market sources said the new plan was being contemplated as promoters did not get the valuation for equipment finance it was looking for.

Existing shareholders of Srei Infra would have only reaped the benefit of unlocking value through the holding company if an IPO had taken place. With the new scheme, the shareholders will directly own the shares of the equipment finance business.

The Telegraph