Mumbai, Oct. 16: Reliance Industries today reported its highest-ever quarterly net profit of Rs 6,720 crore for the three months ended September 30 on a spike in refinery and petrochemicals margins.

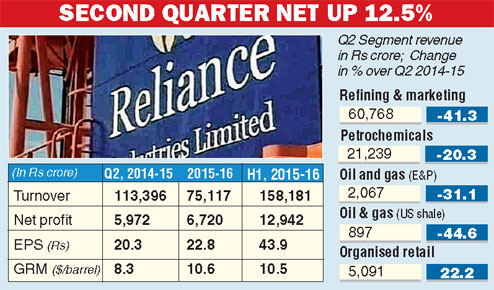

Net profit for the July-September quarter rose 12.5 per cent to Rs 6,720 crore, or Rs 22.8 per share, from Rs 5,972 crore, or Rs 20.3 a share, in the same period of the last fiscal, the company said in a statement.

Analysts had expected the company to post profits of around Rs 6,000 crore.

Sales, however, fell 33.8 per cent to Rs 75,117 crore on falling benchmark crude prices from Rs 113,396 crore a year ago. The decline in its revenue was led by a nearly 51 per cent fall in benchmark (Brent) oil price.

Moreover, exports from India operations were also lower by nearly 36 per cent to Rs 42,636 crore because of lower product prices in line with lower crude prices.

The operator of the world's biggest oil-refinery complex earned $10.6 on turning every barrel of crude into fuel during the second quarter of the current fiscal compared with a gross refining margin of $8.3 per barrel in the year-ago period.

The margins in the September quarter were at a seven-year high and the company's Jamnagar refineries in Gujarat earn $4.3 per barrel more than the Singapore average.

Analysts had expected GRMs for the quarter to come between $9-9.5 per barrel.

The net profit included gains of Rs 252 crore from the sale of investment in US shale gas pipeline venture, EFS Midstream LLC. Net profit after excluding exceptional items was up 4 per cent to Rs 6,468 crore.

Pre-tax profit from the petrochemical business was up 7.2 per cent while that from the oil and gas business declined over 70 per cent on a fall in KG-D6 output.

RIL said it benefited from product mix flexibility, robust risk management and efficient crude sourcing during the quarter.

While revenues from the refining & marketing segments declined during the quarter by 41 per cent to Rs 60,768 crore, margins were higher at 9 per cent compared with 3.7 per cent in the same period of last year.

"We achieved record levels of profits for the quarter, underscoring our ability to optimally utilise our assets across the value chain to leverage favourable market conditions.

"Refining business performance was notable, as it benefited from a combination of high utilisation levels, advantageous crude market opportunities and strong global fuels demand,'' Mukesh Ambani, chairman & managing director of RIL, said.

During the quarter, RIL's Jamnagar refineries processed 17.1 million tonnes of crude with an average utilisation of 110 per cent, which was higher than the average utilisation rates for refineries globally.

RIL's petrochemicals business also churned in a decent performance with margins rising to nearly 12 per cent from 9 per cent in the year-ago period. This came despite revenues from the segment declining 20 per cent to Rs 21,239 crore as product prices remained soft.