New Delhi, Dec. 3: India may levy a capital gains tax on investment from Mauritius unless the entity can show that it is not a shell company and it has added value in the island nation.

India is in talks with the Mauritius authorities to amend a double taxation avoidance treaty which has allowed billions of dollars to be routed into the Indian stock market through the tax haven.

Income from investment made by Mauritius companies are exempt from taxation in India under the treaty.

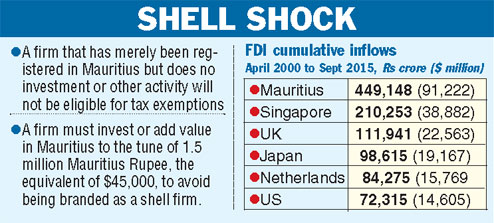

In 2014-15, about a quarter of India's foreign direct investment came from Mauritius.

The thrust of the talks are on inserting a clause on the limitation of benefits in the treaty to make it fit with an OECD code that G20 countries are keen to adopt.

One suggestion being considered by both sides is that a firm must invest or add value in Mauritius to the tune of 1.5 million Mauritius Rupee, the equivalent of about $45,000, to avoid being branded as a shell firm. A firm that has merely been registered in Mauritius but does no investment or other activity there will be considered a shell firm and, therefore, will not be eligible for tax exemptions.

India had in the past inserted provisions on the limitation of benefits in its tax treaties with a number of countries. Lawyers cite treaties signed with Singapore and the UAE as classic examples of such limitation of benefits clause.

New Delhi had in the last decade renegotiated its tax treaty with Singapore to prevent residents of other countries from misusing the capital gains exemption by setting up a holding company in Singapore.

The Singapore treaty allows investments in India from two companies - either the entity is listed on a recognised bourse in Singapore or its annual expenditure on operations is equal to or more than Singapore$200,000 in the 24 months immediately before the date its capital gains arise. Others would be treated as shell companies set up simply to avoid taxes.

"India may not agree in future to give tax benefits to a company which has simply been set up in Mauritius as a screen to buy an Indian asset to avoid paying tax. This kind of corporate operation is called treaty shopping and we could crack down on it by rewriting tax treaties," officials said.

Finance ministry officials point out that foreign institutional investors who have kept shares with them for more than a year will not be affected by the changes in rules as there is zero tax on any share sold on bourses after being kept for a year.

Short-term capital gains stand at 15 per cent while off-market deals, which are the preferred route when one company acquires another such as the Hutch-Vodafone deal, attracts 10 per cent tax.

The revised double taxation avoidance convention is also expected to allow the sharing of banking and tax-related information between the two countries to prevent money laundering and the evasion of taxes.