Equities rallied for the third consecutive session on Thursday with both the benchmark indices rising 1.50 per cent as the state election results offered grounds for optimism vis-a-vis greater policy continuity and more reforms.

However, fears over the impact of crude oil prices on inflation limited the gains.

The buoyant mood in equities spread over the rupee which appreciated 19 paise against the dollar, while the yields on government securities corrected with the softening of crude oil prices.

The poll results triggered more buying at a time investors were looking into value opportunities after the recent bout of correction. The sentiment got a lift from the positive opening in the Asian markets and the cooling down of oil prices.

The 30-share Sensex opened on a strong note at 56242.47 and rose over 1595 points to a day’s high of 54982.82 as the results showed the BJP coming back to power in Uttar Pradesh.

The index pared some gains to close at 55464.39, up 817.06 points or 1.50 per cent. The broader NSE Nifty jumped 249.55 points or 1.53 per cent to close at 16594.90.

Analysts said that with a key event now out of the way, investors will look out for factors such as crude oil prices, the Russia-Ukraine war and any measures by global central banks on the interest rate front.

“The markets hate uncertainty and the outcome of these state elections will provide policy continuity and stability. The central government can confidently look for opportunities to pursue economic reforms,” Devarsh Vakil — deputy head retail research, HDFC Securities, said.

“In the past clear political mandates have led to euphoria in markets though that is unlikely to be the case this time around. Macro-economic variables are not conducive for markets to experience a surge’’, he said.

Some analysts feel that though equities may see some more correction in the days ahead, robust participation from domestic investors will provide some support.

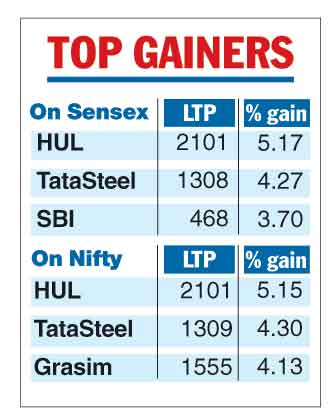

HUL led the gainers list on Thursday as it surged 5.17 per cent. The counter was followed by Tata Steel, SBI, IndusInd Bank, Axis Bank, Bajaj Finserv, Nestle and Maruti Suzuki. Only three stocks ended in the red — Tech Mahindra, Dr Reddy's Laboratories and TCS, slipping up to 1.28 per cent.

At the inter-bank forex markets, rising stock values had a positive impact on the rupee which appreciated 19 paise to close at 76.43 against the dollar. With crude oil prices easing on Wednesday, domestic bonds rallied with the yields on the benchmark 10 year paper closing at 6.80 per cent against the previous close of 6.84 per cent.