Mumbai, Dec. 28: The National Stock Exchange (NSE) today filed draft papers with the Securities and Exchange Board of India (Sebi) for its proposed initial public offering (IPO), which could be the country's biggest in six years.

The leading bourse has filed the draft red herring prospectus (DRHP) with the market regulator and it is expected that close to Rs 10,000 crore will be raised from the much awaited offering.

Rival bourse BSE has already filed its draft papers with Sebi in September for an estimated Rs 1,300-crore offering.

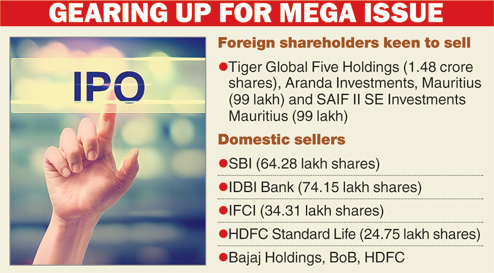

The initial public offer of the NSE for over 11.14 crore shares - which is 22.5 per cent of total shares outstanding - is an offer for sale by its existing shareholders, the DRHP states.

Of the total shares on offer, around 15.8 per cent stake would be tendered by foreign shareholders, and 6.7 per cent by domestic entities. The IPO would be the biggest initial public offering after Coal India, which had hit the capital markets in 2010 to raise over Rs 15,000 crore.

It is expected that the offer may give the exchange a valuation of around Rs 50,000 crore.

In its DRHP, the bourse said the objectives of the offer were to achieve the benefits of listing the equity shares on the stock exchange and to sell the shares on offer. The listing will enhance its brand and provide liquidity to existing shareholders, it added.

The draft papers have been filed with Sebi well ahead of the exchange's own deadline of January 31, 2017. NSE had in June announced its plans to get listed and had said IPO papers would be filed by January next year.

However, the exchange saw the surprise exit of its managing director and CEO Chitra Ramkrishna earlier this month. According to a circular issued by Sebi in December 2012, an exchange is required to forward new names for the appointment of the managing director and CEO within a period of 60 days from the date of resignation.

NSE said in its DRHP that its board of directors has redesignated J Ravichandran, group president, as CEO in-charge until the new CEO and managing director is appointed.

NSE has appointed Citigroup Global Markets India Ltd, Morgan Stanley, JM Financial Institutional Securities and Kotak Mahindra Capital Company as the joint global coordinators and book running lead managers.