Mumbai, Oct. 11: Pharmaceutical firm Lupin today announced it had acquired US-based Symbiomix Therapeutics Llc for $150 million, or Rs 980 crore, in cash.

Symbiomix is a privately held company focusing on therapies for gynaecologic infections.

While the transaction was funded from internal resources, it is expected to give a boost to the Mumbai-based company's women's health specialty business. The acquisition was done through its subsidiary Lupin Inc.

Lupin said the cash consideration of $150 million included a $50-million upfront and other time-based payments. In addition, there are sales-based contingent payments.

"This transaction is an important milestone in our specialty business and gives Lupin a new therapy to bring to obstetricians and gynaecologists. We are delighted to complete the acquisition of Symbiomix and its Solosec brand, which will expand Lupin's women's health specialty business in the US," Lupin CEO Vinita Gupta said.

Solosec is the lead product of Symbiomix. Last month, the US Food and Drugs Administration had approved Solosec oral granules for the treatment of bacterial vaginosis in women.

Lupin expects Solosec to be commercially available by mid-2018 and be eligible for at least 10 years of exclusivity in the US.

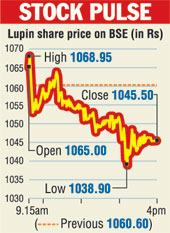

The acquisition, however, failed to lift the spirits of the Lupin stock on a day the benchmark index slipped a little over 90 points. The share closed at Rs 1,045.50, down 1.42 per cent from its previous close.

Lupin, which is the second-largest domestic pharmaceutical firm, has been taking the inorganic route to increase its presence overseas. It is looking to position itself as a company with a larger complex generics mix and is also building its specialty business to overcome the challenges in the US generics market.

By 2020, it expects to have a significant complex generics mix. The North American market accounts for around 42 per cent of Lupin's revenues. During the first quarter of this year, the US business registered sales of $238 million

Symbiomix is the second major acquisition after the deal to acquire Gavis for a $880 million. In a recent presentation, Lupin said it has chosen niche areas within larger therapy areas. These include neurology, paediatric specialty and women's health.

Pfizer strategy

Drug major Pfizer Inc today said it was reviewing various strategic alternatives for its consumer healthcare business, including sale or separation of the vertical.

The company will be considering a range of options, including a full or partial separation of the business through a spin-off, sale or other transaction, the company's Indian arm Pfizer Ltd said in a regulatory filing.

"There is potential for its (consumer healthcare) value to be more fully realised outside the company," Pfizer chairman and CEO Ian Read said.