|

Mumbai, Sept. 9: ICICI Bank today decided to sub-divide its shares to make them more affordable.

The stock split — one share will become five, of lower face value — is the first by the bank.

“The board of directors of ICICI Bank has considered and approved the sub-division (split) of one equity share of the bank having a face value of Rs 10 into five equity shares of face value of Rs 2 each,’’ the private sector lender said in a communication to bourses.

ICICI Bank, which is also listed on the NYSE, added that each American Depositary Share (ADS) will continue to represent two underlying equity shares.

With the number of equity shares rising on account of the proposed split, the number of American Depositary Receipts owned by a holder will also increase in proportion to the increase in the number of equity shares. The share split will be subject to the approval of the shareholders, which will be sought by a postal ballot, apart from regulatory clearances.

ICICI Bank said the record date for the sub-division of shares would be announced shortly.

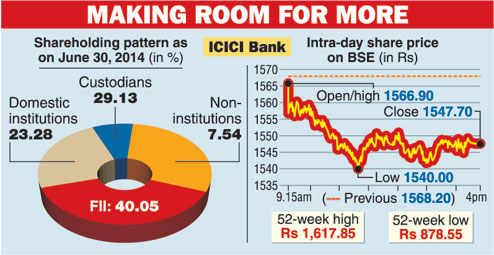

The announcement came after market hours during which the scrip showed a fall of 1.31 per cent, or Rs 20.50, to close at Rs 1,547.70. At this closing price, the share should be available at around Rs 309 ex-stock split.

Despite the slowdown in the economy, private sector banks have seen their valuations rise over the past one year as they have performed better on various fronts, including that of asset quality.

Analysts said that with the domestic economy set for a turnaround, there was still some room for appreciation in banking shares and this should bode well for the retail investor.

So far during this calendar year, while the BSE Sensex rose nearly 29 per cent, the ICICI Bank scrip has shown gains of over 40 per cent.

Better liquidity

Market circles welcomed the move of the private lender to go for a stock split, pointing out that apart from improving the liquidity of the scrip, it will also make it more attractive for the retail investor.

However, ICICI Bank is not the lone bank to opt for a split. Axis Bank went for a similar stock split when it sub-divided its shares from a face value of Rs 10 into five shares of a face value of Rs 2 each. After the split, the Axis Bank share has seen modest gains in its share price.

Jammu & Kashmir Bank had also earlier announced a stock split in the ratio of 1:10.