Mumbai, July 27: ICICI Bank today reported an 8 per cent fall in standalone net profit for the first quarter ended June 30 that was in line with estimates.

The country's largest private sector bank said its non-performing assets (NPAs) rose the lowest in seven quarters.

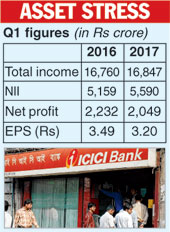

It reported a standalone net profit of Rs 2,049 crore compared with Rs 2,232.35 crore in the same period of the previous year.

The core net interest income of the bank showed a growth of 8 per cent to Rs 5,590 crore from Rs 5,159 crore in the year-ago period.

However, the lender's non-interest income was lower at Rs 3,388 crore compared with Rs 3,429 crore in the same period of last year. Non-interest income in the same period of last year included an exchange rate gain related to overseas operations, which is no longer an income following an Reserve Bank of India guideline.

It had also included a quarterly dividend of Rs 204 crore from ICICI Prudential Life Insurance Company. The insurer now pays dividend half-yearly after its initial public offering in September.

On the advances front, ICICI Bank reported an 11 per cent growth. It continued to leverage its strong retail franchise, resulting in a year-on-year growth of 19 per cent in the retail portfolio, which accounted for 53 per cent of its loans.

Total advances showed an increase of 3 per cent over the corresponding period last year to Rs 4,64,075 crore.

There was good news on the asset quality front that remained stable during the period. The percentage of gross NPAs to gross customer assets stood at 7.99 per cent against 7.89 per cent in the preceding three months. Moreover, the absolute gross NPAs showed only a marginal increase on a sequential basis when it rose to Rs 43,147.64 crore compared with Rs 42,551.54 crore in the fourth quarter ended March 31, 2017.

Chanda Kochhar, managing director and chief executive of the bank, said that the gross addition to NPAs was Rs 4,975 crore during the quarter, the lowest in seven quarters.

She said the bank had an exposure to nine of the 12 banks that had been pulled up under the insolvency code.

Loans outstanding to the nine borrowers stand at Rs 6,889 crore as on June 30. The provision coverage ratio stands at 41 per cent in respect of these borrowers, and an additional provision of Rs 647 crore will be required over the next three quarters.

The RBI had asked banks to initiate insolvency resolution process with regard to 12 accounts under the provisions of Insolvency and Bankruptcy Code.